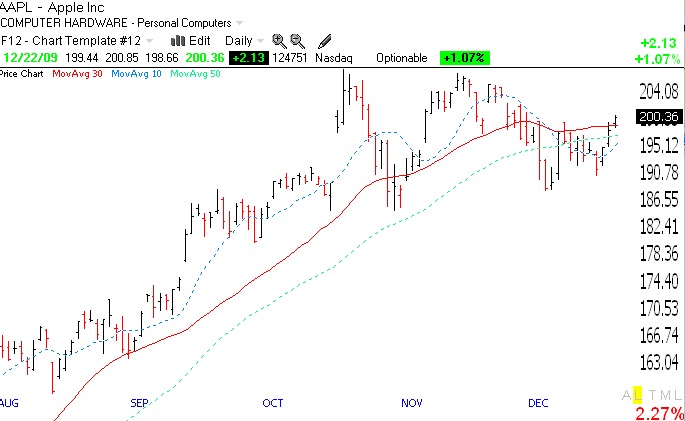

With AAPL now closing above its 30 day average (red line), the short term trend is up again. A close back below the average (currently 199.02) would cancel this up-trend signal. The longer term trend remains up.

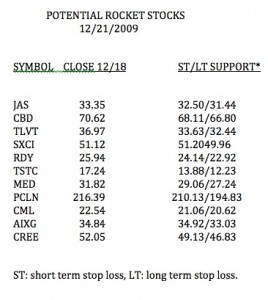

Some new rocket stocks to watch

I used TC2007 to scan the market for stocks that meet my most stringent fundamental and technical criteria for rockets. These stocks have great fundamentals and technicals, have already doubled their price a year ago and are near 5 year or all-time highs. I have listed in this table the 11 stocks out of 4,000 in my stock universe that met these criteria.  All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.

All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.

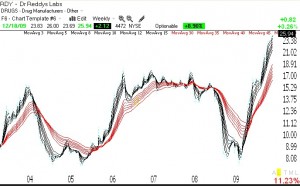

Below is a Guppy Multiple Moving Averages (GMMA) weekly chart (click on chart to enlarge) of one of these rocket stocks, RDY. Note how all of the shorter term averages (black lines) are well above the rising long term averages (red lines). This is the type of technical strength I seek in a potential rocket stock.

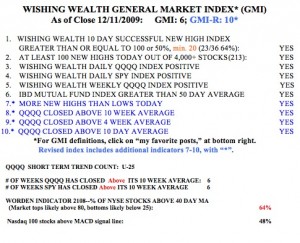

Meanwhile, the GMI and GMI-R remain at their maximum levels.

AAPL still a concern; QQQQ holding up

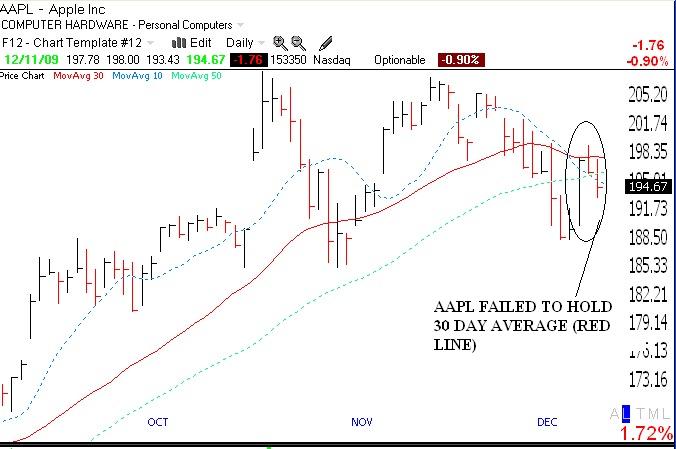

I am still concerned that AAPL (and NFLX) is showing technical weakness. On Friday, the stock could not hold its 30 day average and its 10 day average (blue dotted line) remains below its 30 day average.  See the daily chart for AAPL below. While AAPL could always break above its 30 day this week, until it does, it may be flashing a short term down-trend. Another stock that I am short is EMS, which may also be flashing a sell signal. EMS may have formed a head and shoulders top. Nevertheless, the GMI and GMI-R are at their maximum values. So the QQQQ (Nasdaq 100 ETF) is still in short and longer term up-trends. The Worden T2108 Indicator is at 65%, in neutral territory. The daily stochastics for the QQQQ are flat and in neutral territory. So I continue to ride QLD but remain cautious, with the weakness in AAPL and NFLX.

See the daily chart for AAPL below. While AAPL could always break above its 30 day this week, until it does, it may be flashing a short term down-trend. Another stock that I am short is EMS, which may also be flashing a sell signal. EMS may have formed a head and shoulders top. Nevertheless, the GMI and GMI-R are at their maximum values. So the QQQQ (Nasdaq 100 ETF) is still in short and longer term up-trends. The Worden T2108 Indicator is at 65%, in neutral territory. The daily stochastics for the QQQQ are flat and in neutral territory. So I continue to ride QLD but remain cautious, with the weakness in AAPL and NFLX.