Both the GMI and GMI2 rose to 2, but the short term down-trend is still in place. IBD also says the market is still in a correction. The market has snapped back on unimpressive volume, suggesting to IBD that the institutions are not jumping on board. I remain mainly in cash with a couple of small short positions. Check out the daily chart of the QQQQ below (click on chart to enlarge). The short term up-trend that began last September is now over. The new short term down-trend is 10 days old. How long will it last? No one knows. I follow trends until they end.

9th day of QQQQ short term down-trend;

The QQQQ short term decline completed its 9th day on Friday. Both the S&P500 Index ETF (SPY) and the Nasdaq 100 Index ETF (QQQQ) have closed below their 10 week averages. IBD continues to designate the market to be in a correction.

I am safely out of the market, in cash in my trading IRA. I own a little of the ultra 2X short QQQQ ETF, QID, which is designed to rise 2X as much as the QQQQ falls. I remain fully invested in mutual funds in my university pension account, which limits fund transfers. I only transfer out of mutual funds and into money market funds in that account when my longer term indicators signal a major decline. Right now, the long term trend remains up.

But in my trading IRA where I can go in and out of the market at will, with no tax consequences, I remain mostly in cash. Why ride stocks down or try to find the few that will gain in a declining market? Since the QQQQ short term down-trend began on March 8, that index ETF, QQQQ, has declined by -5.2%. During the same period, 92% of the Nasdaq 100 stocks and 82% of the S&P 500 stocks have declined. Why fight the tide? Years ago, I used to make money in an up market only to lose all of my profits and more in the subsequent decline. Going to cash clears my mind and enables me to comfortably plan future strategy.

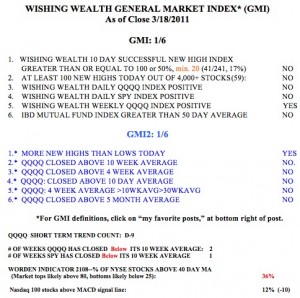

So, the GMI and GMI2 remain at 1 each.  (Click on table to enlarge.) These indicators keep me on the right side of the market’s trend. The Worden T2108 indicator is now at 36%, low but not yet at an oversold extreme. Only 12% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line, a sign of short term weakness. I am monitoring stocks, looking for those that resist the down-trend. These stocks may be the leaders when the up-trend resumes.

(Click on table to enlarge.) These indicators keep me on the right side of the market’s trend. The Worden T2108 indicator is now at 36%, low but not yet at an oversold extreme. Only 12% of the Nasdaq 100 stocks closed Friday with their MACD above its signal line, a sign of short term weakness. I am monitoring stocks, looking for those that resist the down-trend. These stocks may be the leaders when the up-trend resumes.

8th day of QQQQ short term down-trend; longer term up-trends intact; RWB: AIRM

The QQQQ completed the 8th day of its short term down-trend on Thursday. In that period the QQQQ has fallen -4.8%, the SPY by -3.6% and the DIA by -3.5%. These indexes are down even more from their February closing highs (QQQQ – 7.2%, SPY -4.9% and DIA -4.8%). Of course, the inverse ETF’s advanced greatly during this period. Since I identified the QQQQ short term down-trend as beginning on March 8, TYP has increased by +18% and SQQQ by + 15%. I remain mainly in cash and in some QID in my IRA trading account. The longer term trends of the QQQQ, SPY and DIA remain in a Stage 2 up-trend.

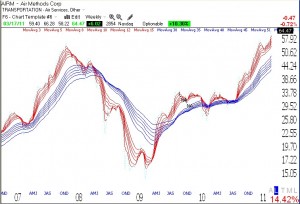

I was looking at the daily new high list from Thursday and noticed an incredible cup-with-handle break out formation. When it announced earnings a few days ago, AIRM broke out of a beautiful pattern to an all-time high on daily volume which was many times its average volume. I will keep an eye on this stock for a possible purchase when the market down-trend ends.

AIRM is also an RWB rocket stock. Click on weekly chart to enlarge.