The markets remain in short and longer term up-trends.

5th day of QQQ short term up-trend; APKT doubles

The QQQ short term up-trend reached the 5th day on Tuesday. I am now more confident that this up-trend can last for a while. With options expiration coming at the end of next week, we may see continued strength in the leading stocks. Note that the Worden T2108 is now at 74%, getting closer to overbought levels. When T2108 is above 80%, the market often peaks.

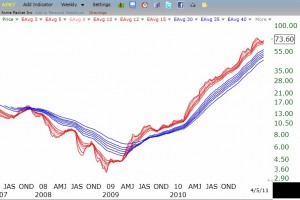

Last October I wrote about APKT as an RWB rocket stock. It was a stock that my stock buddy, Judy, has often talked about. APKT was around $37 in October. It closed Tuesday at $73.60 and remains in an RWB pattern. In fact, by my technical criteria, APKT bounced off of support yesterday. It reports earnings on April 26 and we are now in the period when stocks tend to move in anticipation of earnings.