Very high volume buzz. Bought a call option.

Bullish and bearish adviser sentiment converges

With the latest poll showing almost as many bears as bulls, the market looks set to rally. It is rare for there to be so many bears. The T2108, at 31%, is also in neutral territory. This bottom may be solid. Nevertheless, I will still wait for higher GMI readings before I wade into this market.

New QQQ short term down-trend; mainly in cash, and one AZO call

The QQQ began a new short term down-trend on Tuesday. Nevertheless, note that bearish adviser sentiment is only 4 percentage points below bullish sentiment. This is a contrary indicator and suggests that much of the selling may be over. It is rare that bearish sentiment gets close to or above bullish sentiment. The T2108, while low at 22%, is far above the 7% seen at the lows on August 8. If the August lows hold, we could see a major rally develop. I remain almost 100% in cash until a longer term up-trend develops with the GMI around at least 4.

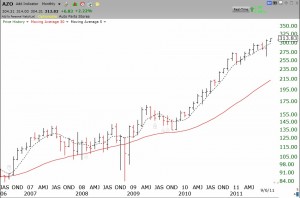

Continuing my search for new leaders, note that two auto parts stocks, AZO and ORLY, showed up on the new 52 week high list on Tuesday. I could not resist buying a Sept 300 call option on AZO, in my most speculative trading account. Having a stock at a new high after all of the market weakness is a terrific sign of technical strength and AZO could rise if the market rebounds. AZO is one of the nine high priced leaders I follow regularly. Below is a monthly chart of this growth stock (click on to enlarge).