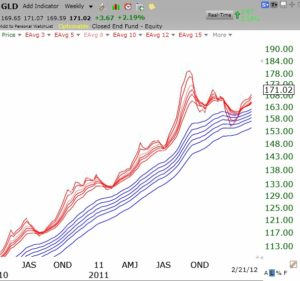

GLD and mining stocks continue to climb.

38th day of QQQ short term up-trend; GLD resuming rise?

It looks like GLD is about to rise again.Check it out along with the mining stocks. This is a weekly GMMA chart–it has an RWB pattern.

Judy’s pick: INVN

I was just talking with my stock buddy Judy who urged me to take a look at INVN, which she owns. She loves the concept and the technical pattern. I would suggest that my readers research the company and put it on their watch lists. I do not own INVN but Judy is extraordinary at picking winners long before others discover them. No guarantees, however!