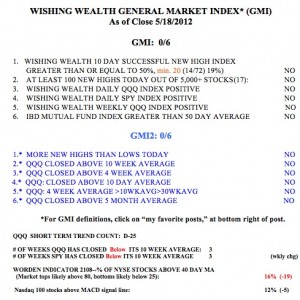

The put/call ratio is at an extreme level, about 1.3, implying a bounce soon. It is a contrary indicator such that when there are more puts than calls, like on Friday, the market is likely to rebound. And the T2108 is very low, at 16%. The GMI is now zero for the first time since December 15, 2011. With all of my indicators negative, is this the time to short stocks or the stock indexes? With my son’s help, I have published my first TA video post, on the current market and the infamous “Sell in May and Go Away” mantra. Let me know if you want more videos and any suggestions for making them more useful to you.View it full screen to see my charts clearly.