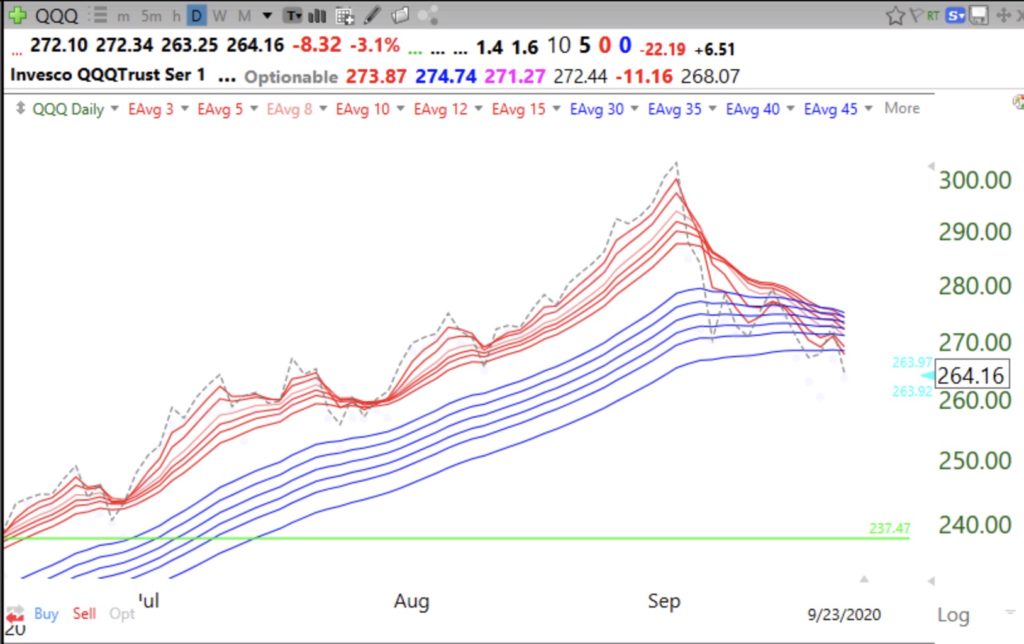

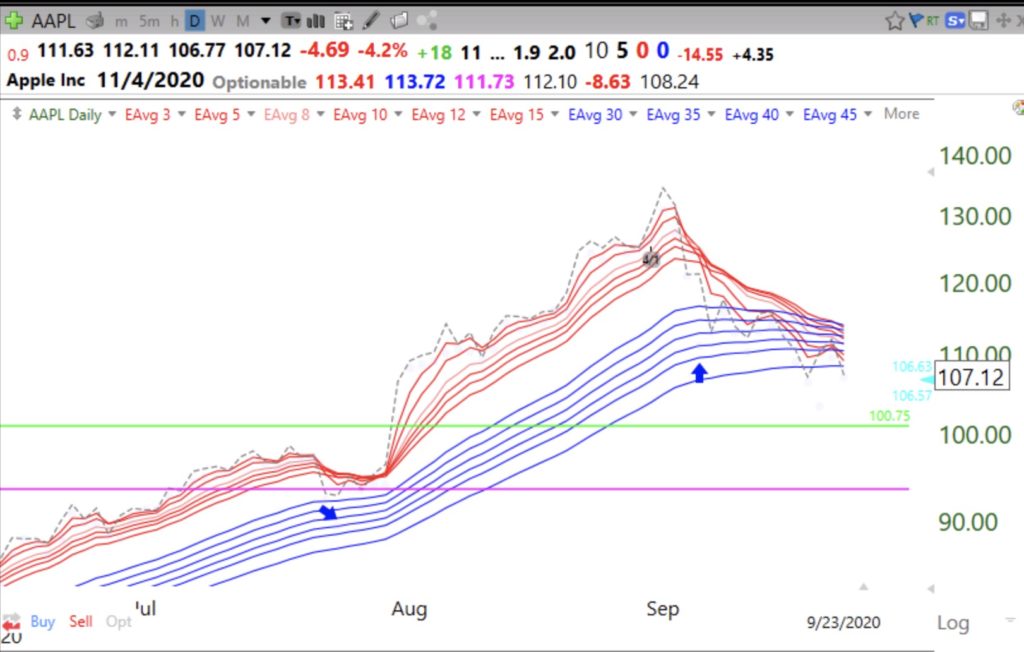

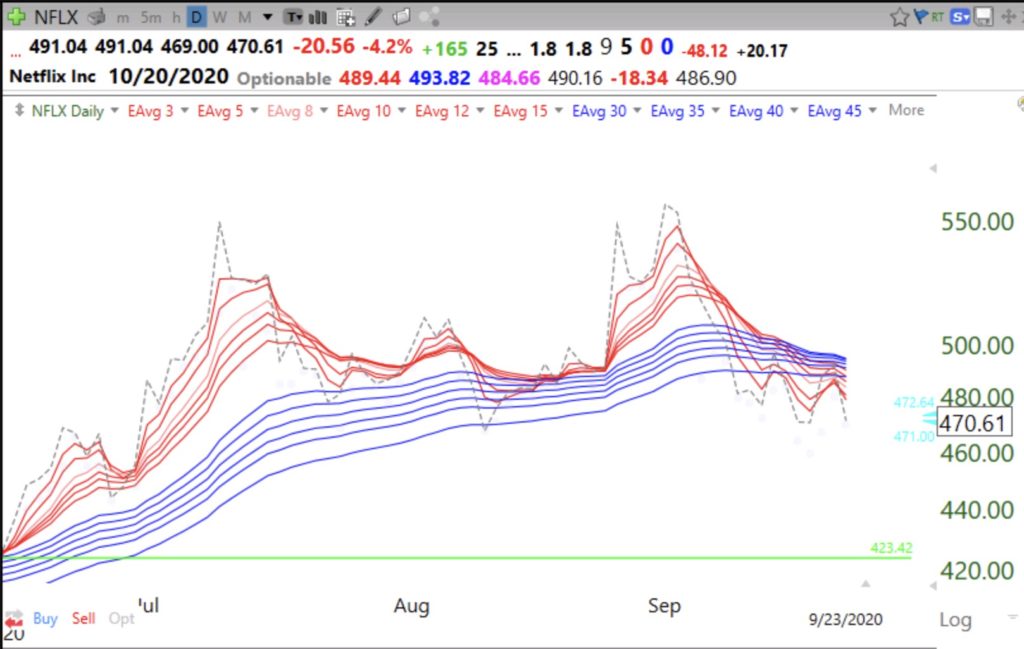

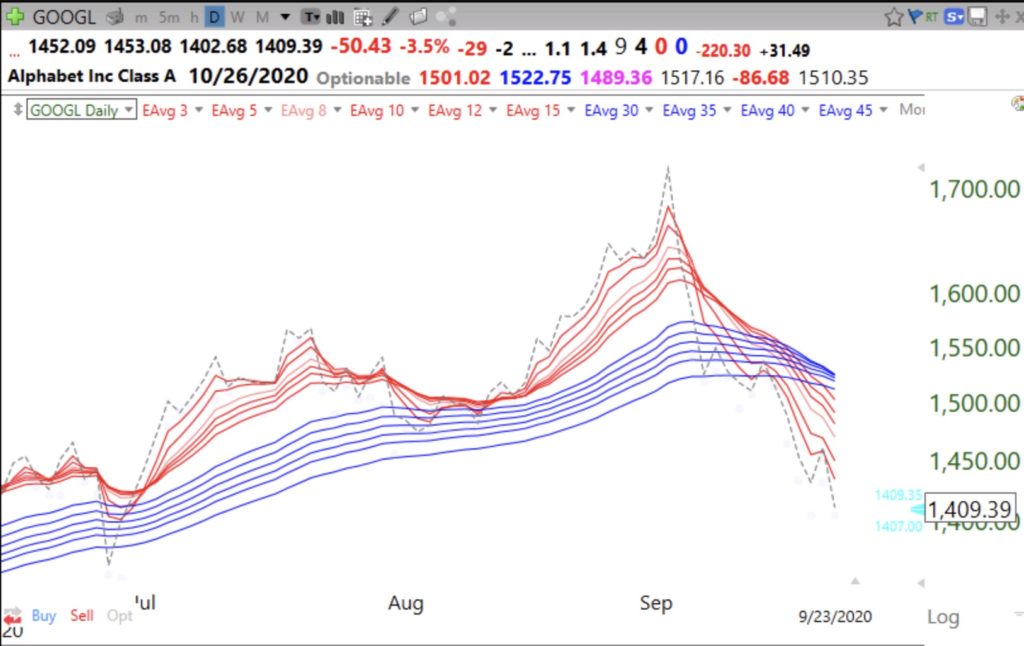

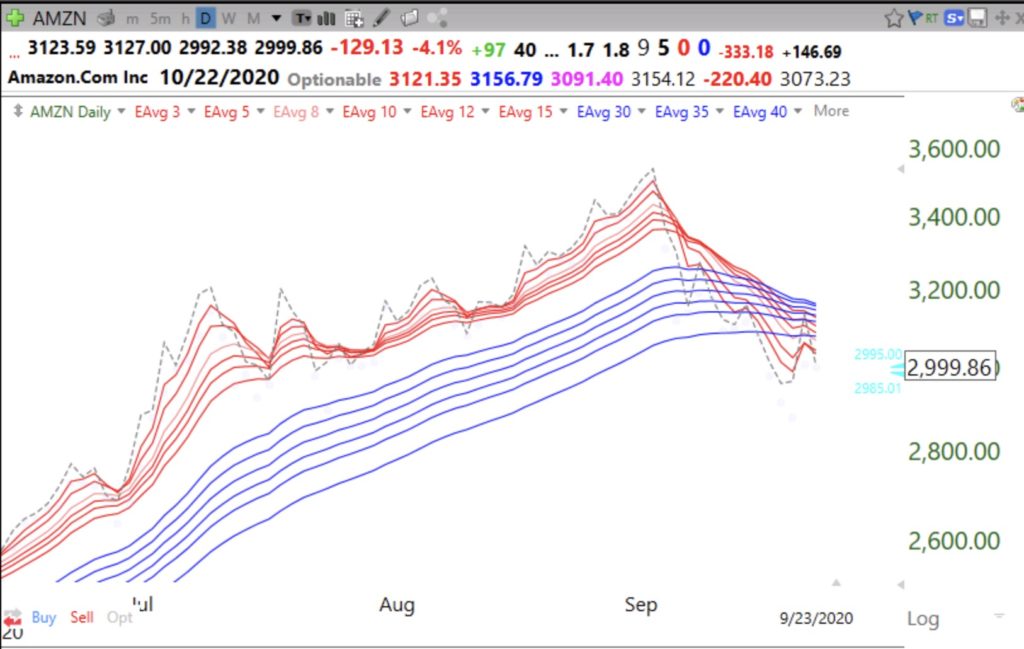

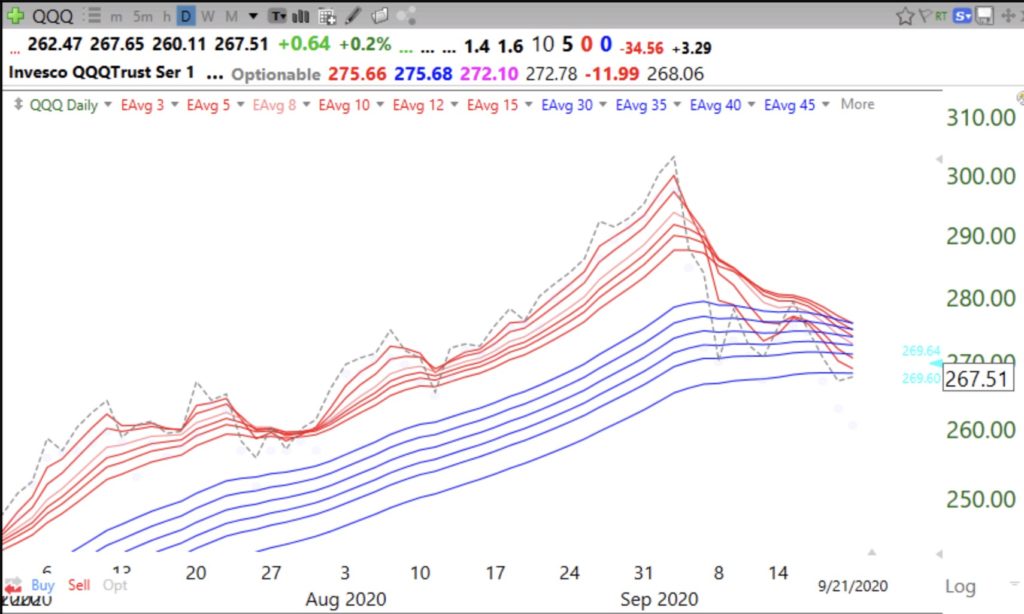

T2108 is already at 20% but the put/call ratio = .75. There is not enough bearishness for this decline to end. With a messy election coming up and the weak month of September and October, it is time for me to be in SQQQ and/or cash. This decline may be just getting started and the bear is eyeing the FAANG stocks. Beware as the big boys unload these stocks–I remember what happened to the buy and hold forever Nifty Fifty in the 70s.