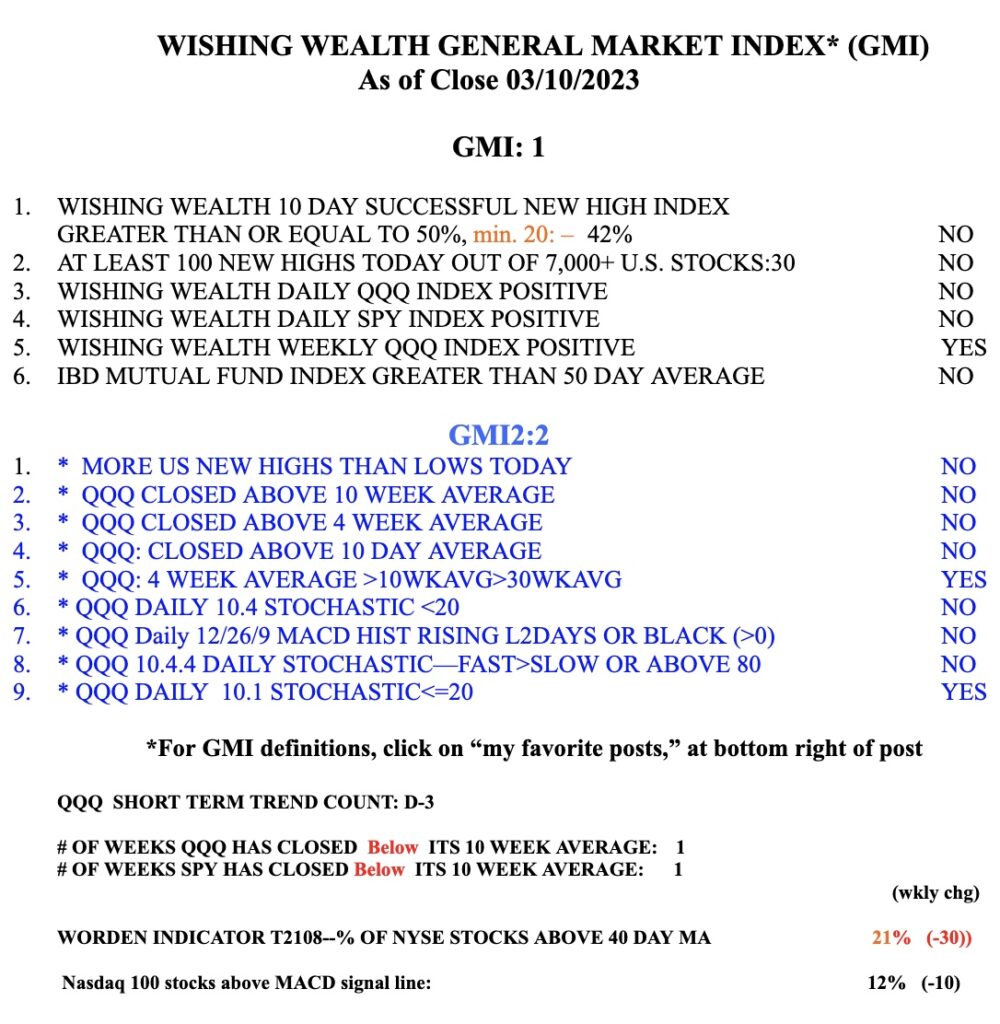

With the GMI at 1 (of 6), it is time to be on the sidelines in cash again. So many bullish set-ups failed last week. If T2108 declines to below 10%, I may buy a little SPY and only average up, slowly. But SPY looks quite weak now, below its declining 30 week average (red solid line), in a Stage 4 decline. Note the above average volume last week. This could portend a massive decline to the lower trend channel line, around 320. That is a worst case scenario, but with a major bank failing and a debt limit fight on the horizon……… But if to avoid a spreading bank panic the Fed slows its rate increases, we could see a huge snap back rally. The main positive technical sign I see is that the 10 week average (dotted line) remains above the 30 week average. Where that ends up will tell the story.