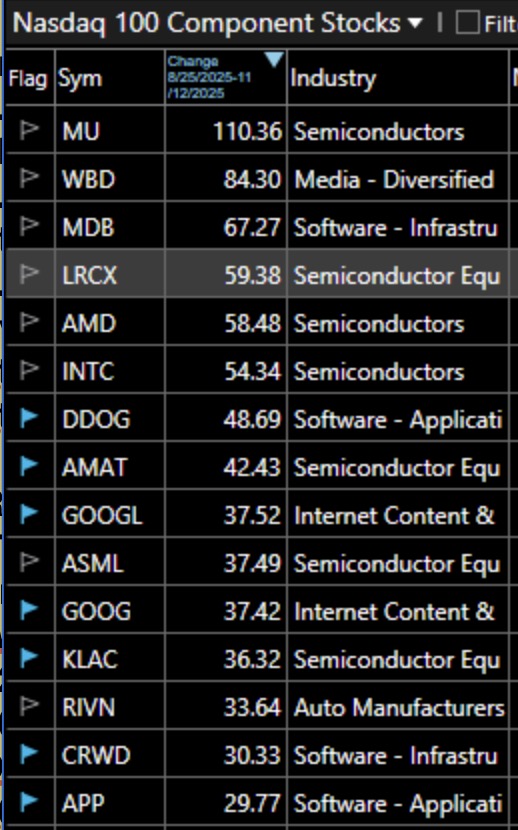

Rather than trying to predict the minority of individual stocks that will beat TQQQ, the needle in the haystack, why not buy the haystack? See Les Masonson’s excellent new book about TQQQ. Find his book listed in this blog page. These 15 stocks did better than TQQQ. MU did best with a gain of 110.36%. Almost one half (7) were semiconductor companies. Did you buy them on Day 1 on 8/25? Buying TQQQ on Day 1 is easier, but scary. You are buying at the beginning of a new up-trend, which you may not trust. I have replicated this analysis many times over the years with the same results.

Screenshot