I did an analysis of the length of all of the QQQQ short term up-trends (as defined by me) going back to July, 2006. Including the current up-trend, there have been 25. Six (24%) of these past 25 up-trends lasted for more than 50 days. Of these 6 longest up-trends, 4 lasted between 50 and 59 days and two lasted more than 60 days (86 and 80 days). So this tells me that given that the current QQQQ short term up-trend completed its 49th day on Friday and it would take a minimum of 2 more days (for my indicator to turn negative) to end the up-trend, we are in the vicinity of where most of the longest short term up-trends have ended. Now, I am the first to say that anything is possible in the market and precedents are meant to be broken. But I like the odds to be on my side. Given that the QQQQ has risen almost nonstop since early September (almost +15%), it may be a good time for me to take off some of the leverage inherent in my call options now and to get ready to exit my swing positions if the trend turns down. I am not exiting my longer term university pension mutual funds because the longer term up-trend remains intact and any short term down-trend could be quite short.

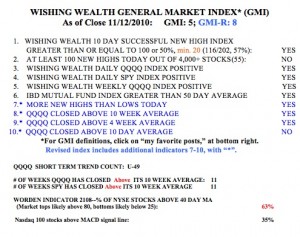

The GMI has declined one, to 5 and the more sensitive GMI-R two, to 8. (Click on chart to enlarge.) The SPY and QQQQ have closed above their critical 10 week averages for 11 weeks. Note that the Worden T2108, an indicator that acts as a pendulum of the market, has declined to 63%. This means that only 63% of NYSE stocks are above their 40 day moving averages, and that the market is now out of the area where market peaks occur. On the other hand, the T2108 is far above the level (below 20%) where market bottoms tend to occur. Another sign of weakness is that only 35% of the Nasdaq 100 stocks closed with their MACD above its signal line.

(Click on chart to enlarge.) The SPY and QQQQ have closed above their critical 10 week averages for 11 weeks. Note that the Worden T2108, an indicator that acts as a pendulum of the market, has declined to 63%. This means that only 63% of NYSE stocks are above their 40 day moving averages, and that the market is now out of the area where market peaks occur. On the other hand, the T2108 is far above the level (below 20%) where market bottoms tend to occur. Another sign of weakness is that only 35% of the Nasdaq 100 stocks closed with their MACD above its signal line.

I am not looking to take on new positions now, but I will buy an inverse (bearish) index ETF if the QQQQ enters a short term down-trend.