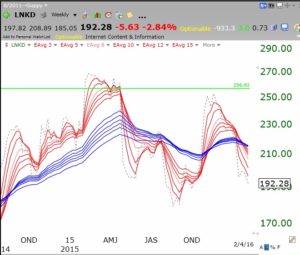

Nice to be in cash. LNKD next leader to crumble today. Even before today, this weekly chart shows that LNKD was a failed green line break-out (GLB) and trading below its critical 30 week average (red line). It also was beginning a BWR down-trend. None of my students would have been holding it!

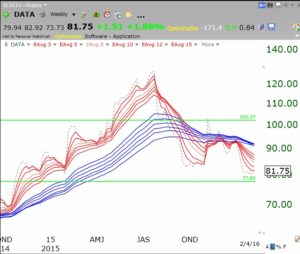

As did DATA:

Ignore the technicals at your own risk…….