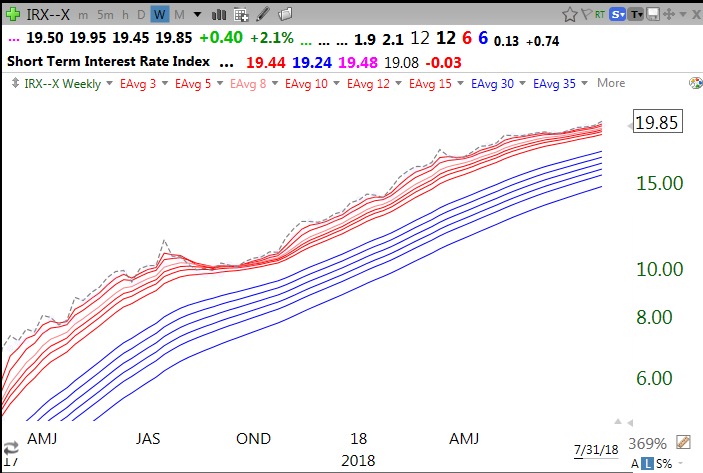

The green dot tutorial is available here at my TC2000 club. I have found the green dot signal useful for alerting me to a rebounding short term up-trend when the security is in a longer term up-trend. Of course, not all green dot signals work out. I tweeted the signal on Thursday intraday (@WishingWealth).