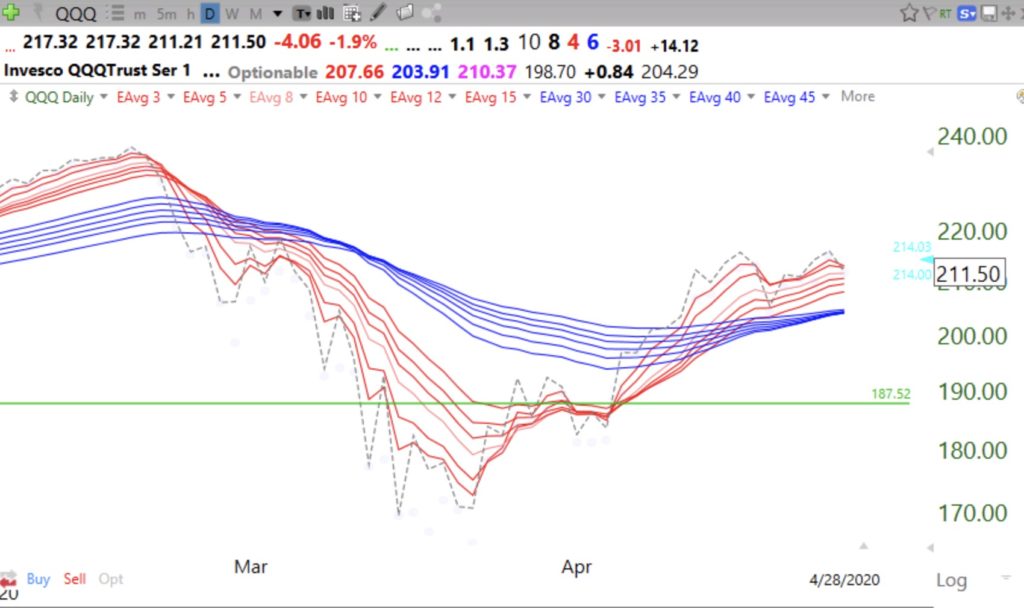

With very few stocks hitting new highs, my strategy of buying strength is not very profitable. I am torn between following my GMI indicators, which are on a Green signal, and my reasoning, which suggests that the market is misjudging the length and severity of the current economic decline. I prefer to remain on the sidelines. In addition, SPY still appears to be in a Stage IV decline. See this weekly chart. If this rebound fails, it will get bloody. And it is Sell in May and go away, come back at Halloween time.