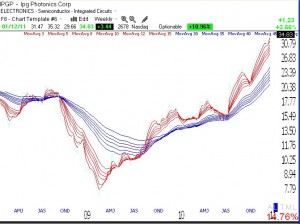

The Worden T2108 Indicator registered 72%, indicating that 72% of NYSE stocks closed above their simple 40 day moving average. Readings above 80% typically signal at least a short term top. ARMH, which I wrote about when it broke out from a cup with handle pattern has been very strong. Check out the weekly GMMA chart for IPGP. It clearly has an RWB pattern with all of the short term averages (red lines) well above the rising longer term averages (blue).

Dr. Wish

Dr. Wish

35th day of QQQQ short term up-trend

Short and long term trends remain up.