While volatile, the market up-trend has been holding. I am back into this market. I am 100% invested in mutual funds in my university pension and own the ultra long (2X) index ETF’s QLD and DDM in my trading accounts.

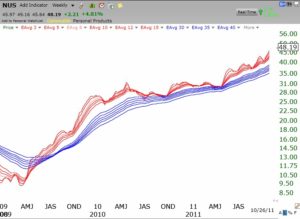

Stocks that hit a new high on Wednesday and have good fundamentals are: SPRD,WPZ,PII,OKS,MAT,QCOR,VSEA,ORLY,NUS. All of these have RWB rocket patterns. My students should research them for possible buys. Check out this RWB pattern for NUS. Click on chart to enlarge.