Another day with the GMI below 3 will trigger a GMI sell signal. The QQQ short term up-trend turned 72 days old on Tuesday and could end on Wednesday. I lightened up on long positions and am getting ready to go to cash in my trading account. I have not sold out my mutual funds in my university account, given that this still looks like a Stage 2 major up-trend. The Worden T2108 reached 21%, getting closer to an oversold level. Many declines have ended when the T2108 is below 20%.

Dr. Wish

Dr. Wish

GMI falls to 3; QQQ short term up-trend reaches day 71

The GMI and GMI-2 each registered 3 (out of 6) on Monday. The QQQ is holding up much more than the SPY and DIA, both of which have closed below their 30 day averages. The GMI is weighted more toward the tech stocks measured by the QQQ and the GMI is not in any imminent danger of flashing a sell signal of two consecutive days of 2 or less. The Worden T2108 indicator fell to 32%, still in neutral territory. It will be interesting to see if we get a bounce in the indexes as earnings season begins.

See you at the Worden DC Seminar? IBD sees market in correction.

As you know, I use the Worden TC2000 charting software daily to follow the market and to teach my university course on technical analysis. The Worden group has graciously invited me to speak at their seminar on Friday and Saturday. You can check out the agenda on their site. I hope to meet many of you there. If you can’t make it, I will post here when the session tapes are made available.

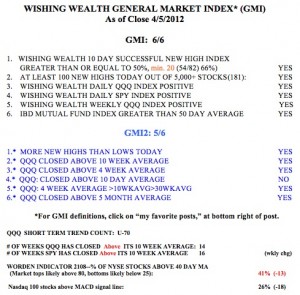

Meanwhile, the GMI is back to 6 (of 6) even though the futures indicate a rocky start on Monday. I am a little worried that last week, IBD labeled the market in a correction.  They have a very good track record on calling the market trend. I remain long, however, until the GMI shows major weakness. But I may cut back a little in the holdings in my trading account. The Worden T2108 Indicator remains at 41%, in neutral territory. By my count, Thursday was the 70th day of the current QQQ short term up-trend. This is quite long for an up-trend to continue. I am also concerned that only 26% of the Nasdaq 100 stocks closed with their daily MACD above its signal line. This indicates short term weakness.

They have a very good track record on calling the market trend. I remain long, however, until the GMI shows major weakness. But I may cut back a little in the holdings in my trading account. The Worden T2108 Indicator remains at 41%, in neutral territory. By my count, Thursday was the 70th day of the current QQQ short term up-trend. This is quite long for an up-trend to continue. I am also concerned that only 26% of the Nasdaq 100 stocks closed with their daily MACD above its signal line. This indicates short term weakness.

I am not going to highlight promising technically strong stocks today, and will wait instead until the markets show more strength.