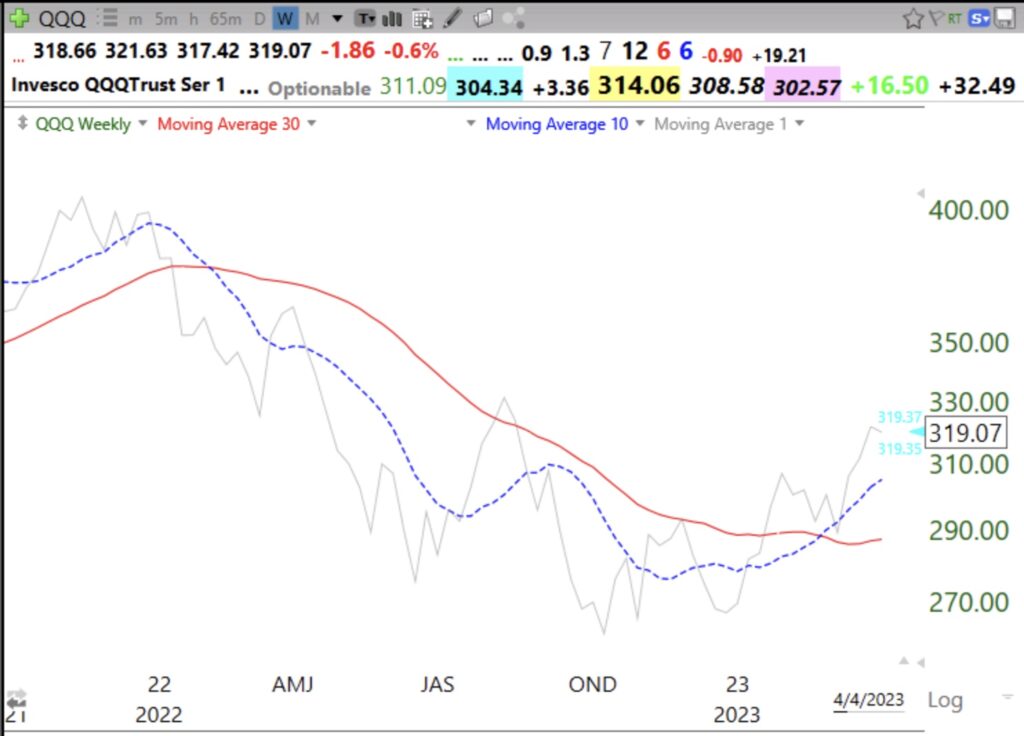

This weekly chart usually alerts me to market turns. QQQ is closing (gray line) above the 10 week average (dotted line) which is above the 30 week average (solid line). And the 30 week average is beginning to turn up. This would also be considered a beginning Weinstein Stage II up-trend. All recent market bottoms have this pattern. As long as the 10 week is rising above the 30 week average the up-trend is intact. Note the 2021 top. The first sing of weakness is a weekly close below the 30 week average.

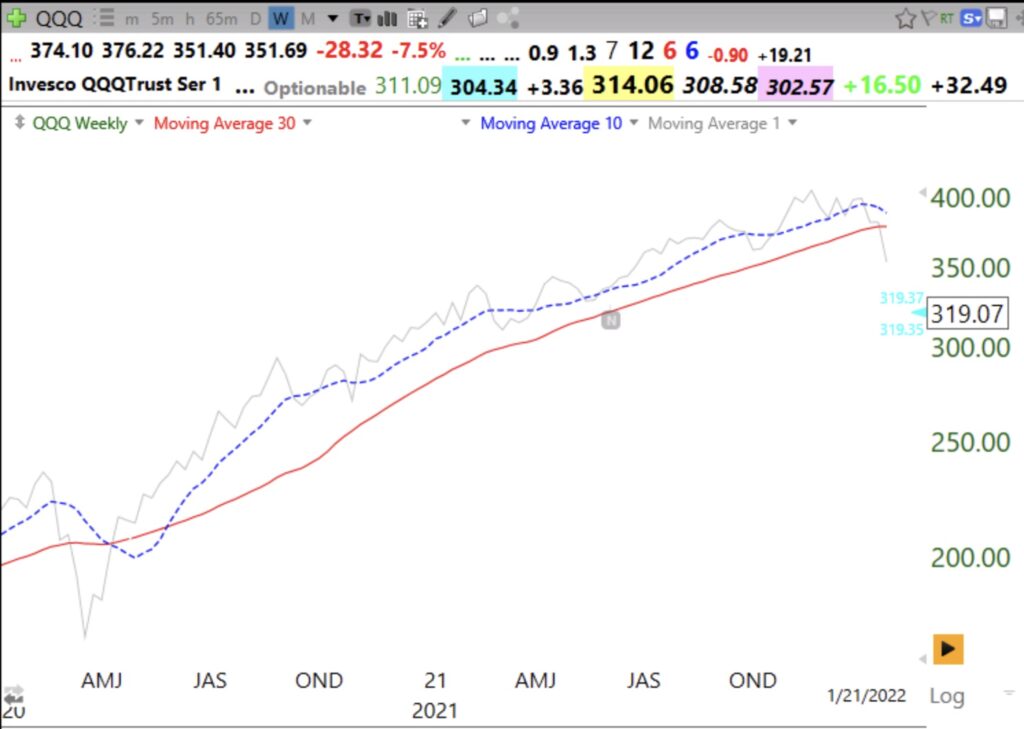

Note the beautiful 2020-2021 bull market.

I’m not as thrilled about this market b/c SP500 has not yet crossed it’s downward trend line. Also, QQQ is near recent resistance. Also, I’ve gone through many stocks in the SP500 and it’s amazing how many are 30-50% off their highs. Finally, T2108 is at 34… but this is 3 weeks into the rally. Something is off. Perhaps this will be like the 1999/2000 when small caps were in the toilet, and techs basically had a climax top, while the SP500 severely lagged in a trading range. Strangely, small caps had their lows around the same time that the Nasdaq topped.

Hi Dr. Wish! Where would you have bought on that chart of the 2020-21 Bull market of QQQ that you just posted?