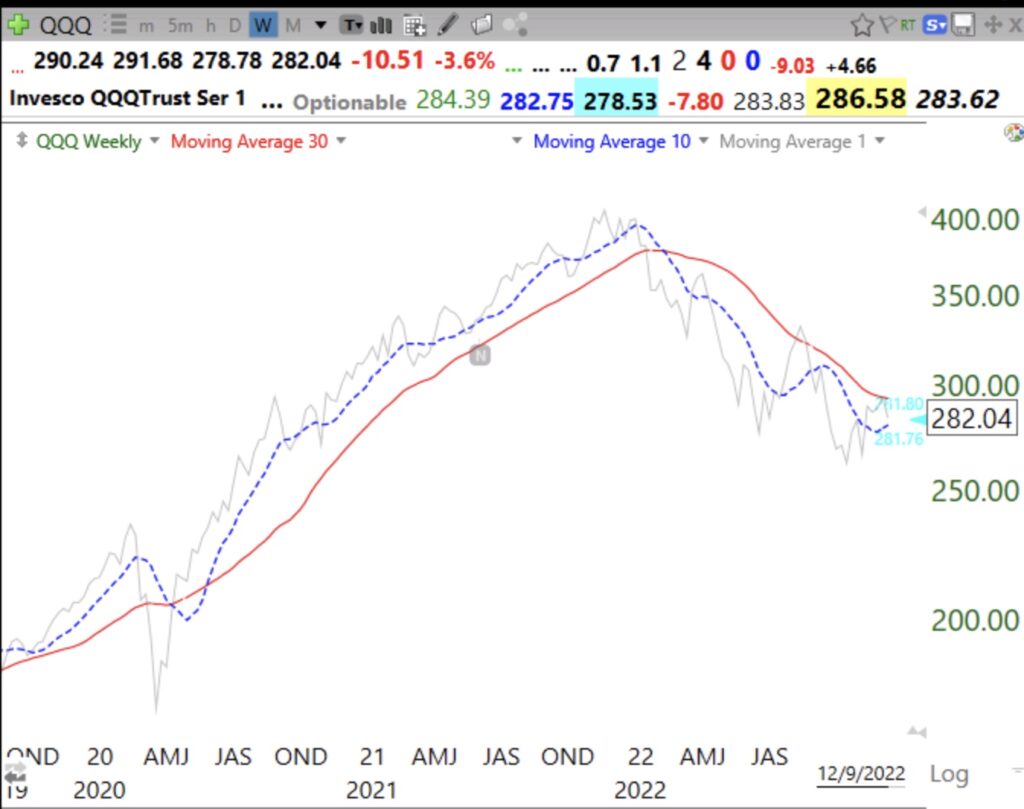

This week will be very volatile and tell me whether the October bottom will hold. Among US stocks on Friday, there were 86 yearly highs and 245 lows. Only 14 stocks reached an ATH (all-time-high). On the plus side, SPY and DIA are still above their 30 week averages. But QQQ is below its falling 30 week average (Stage 4)but above its 10 week average. A close this week below its 10 week average would signal to me a likely new leg down. Here is the weekly chart for QQQ. On the plus side, its 10 (blue dotted line) and 4 week (pink dotted line) averages are rising. But they were rising last August before the subsequent decline.

My prime signal to get heavily back into this market is for QQQ to rise above its 10 and 30 week averages and for the 10 week to climb back above the 30 week. Take a look at this 10:30 weekly chart and see what happened at the 2020 bottom and compare it to the current pattern. The gray solid line is the weekly close which os below the 30 week average. When the 10 week retakes the 30 week and the 30 week rises, the bull will be back.

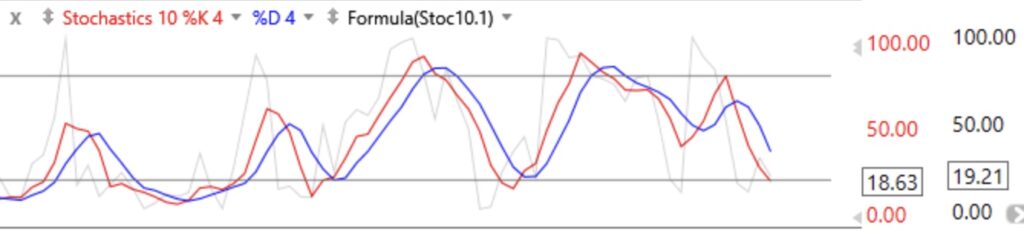

On the other hand, with the daily 10.4 stochastic indicator (red line) now below 20 (18.63), QQQ is at an oversold level where rebounds often occur.

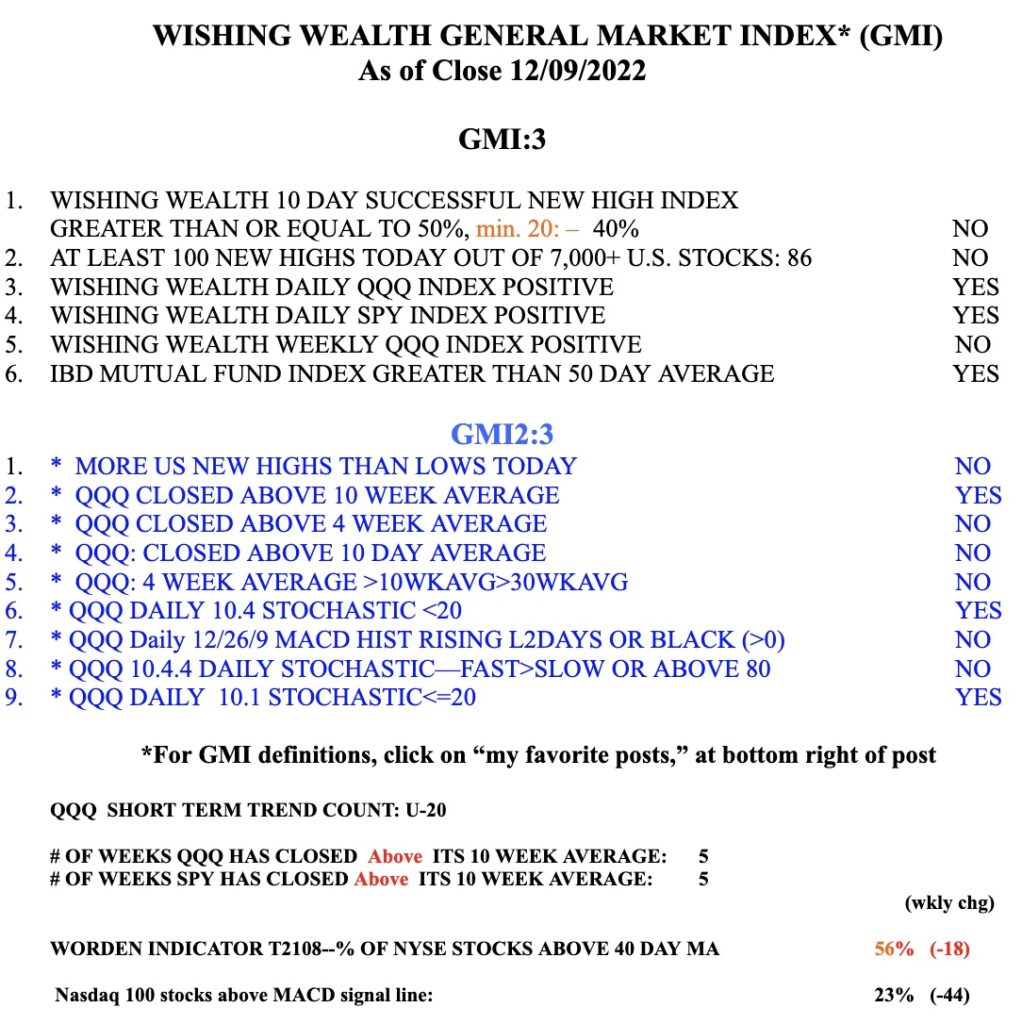

The GMI has weakened to 3 (of 6) but is still on a Green signal.

I really appreciate this. Thanks very much for posting. I’ve been learning a lot from you. Merry Christmas!

I endorse Skrod’s comment, true for me too. Question: you use QQQ as indicator of the trend. Given 2022 experience, is it time to give the SPY and IWM more weight about the trend?

Thanks for your question. I primarily buy CAN SLIM type growth stocks which typically are more reflected in the NASDAQ 100 index.

Thank you, happy holidays to you too!!