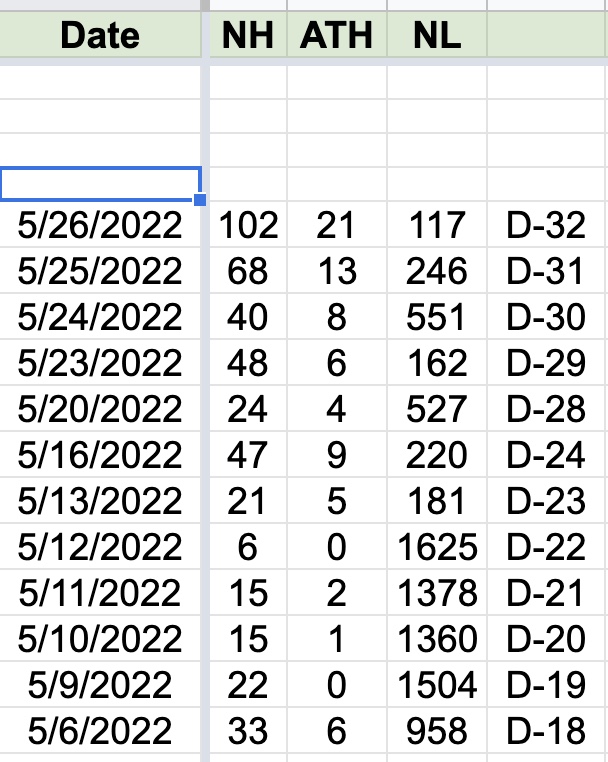

On May 9-12, between 1360-1625 of US stocks reached the lowest price they had traded in the past 250 days. From May 13-26, even though the indexes declined further, no day had more than 551 new lows. This meant that while the indexes declined to new lows, fewer stocks did. This is the reverse of what we had in November when the indexes were hitting highs but the number of new highs was declining and new lows were climbing, which alerted me to exit the market. Tracking the number of new lows and highs may be a worthwhile activity for gauging the market’s strength. This strategy is somewhat different than just calculating the difference between yearly highs and lows. I use TC2000 to count and record the number of new highs and lows after each day’s close. ATH=all-time high and the last column is my QQQ short term trend count. Having 100 or more new highs in a day is one of 6 components in my GMI (general market index) and explains why it increased to 1 ( of 6) today.

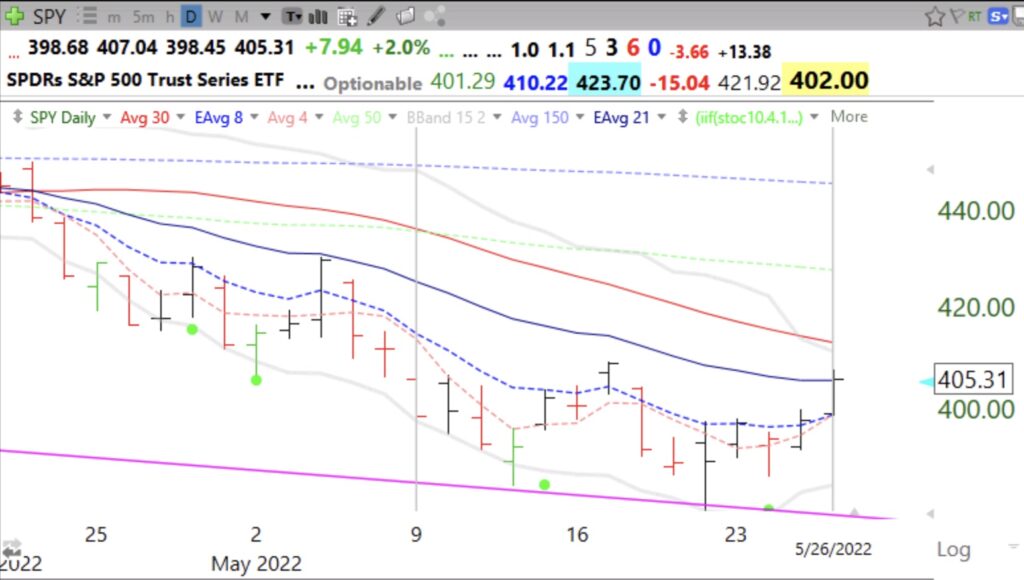

See how QQQ and SPY traded during this period.

Tracking new highs and lows is indeed a useful activity. IF you subtract new lows from new highs on the NYSE AND that result is positive three days in a row, that indicates a healthier market.

How do you identify new ATH for the Day in TC2000? The Worden discussion forum tells me that this is not possible:

“It is not possible to create a formula for stocks making a new high for the day, because there isn’t syntax for determining first bar of the day or the time of day of the current bar of the day in the Personal Criteria Formula Language.

About the closest you could get would be to check if the current price is the high of the day. You would need to do so by creating your formula in a Daily Time Frame:”

“Blessed are those who can read….” Found the solution in your TC2000 video from September 2021, Thanks