On March 29, with CHWY at 36.11, I posted the following::

“Also, I love CHWY, based on my own wonderful experience ordering food and toys for my newly inherited dog. CHWY has been said to be the Amazon of pet supplies. And owners pamper their pets in hard times. I set an alert in TC2000 to tell me when CHWY makes a GLB, at $41.18, but may buy a smidge now (just before earnings) in case it pops with earnings.

As Jesse Livermore and I, much later, have observed, a recent IPO that forms a peak (green line top), consolidates, and then closes at an all-time high on above average trading volume (GLB), can be a screaming buy as long as it keeps closing above its prior peak (green line). Here is CHWY’s daily RWB chart.”

Since then CHWY posted earnings and last Thursday had a GLB on above average volume. Below is its weekly chart. Note the all-time high in relative strength vs. the SPY too. I took a position on Friday. As long as CHWY closes above the green line (41.18) I will hold it. A close below that price will signal a failed break-out and I will sell immediately. The one major concern I have is going long a stock when the longer term trends of the market indexes are still declining. Thursday was the third day (U-3) of the new QQQ short term up-trend, however. IBD considers the market to be in a confirmed up-trend.

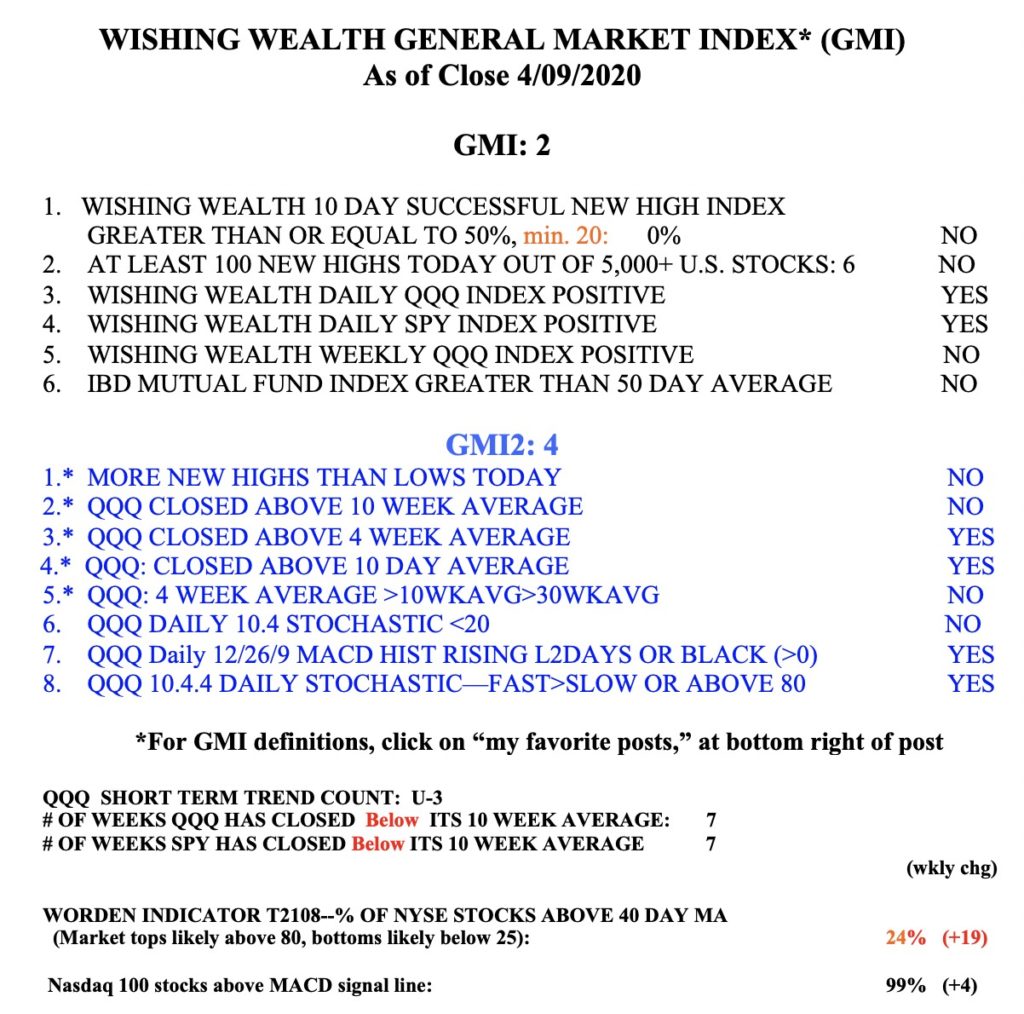

The GMI=2 and is still Red.