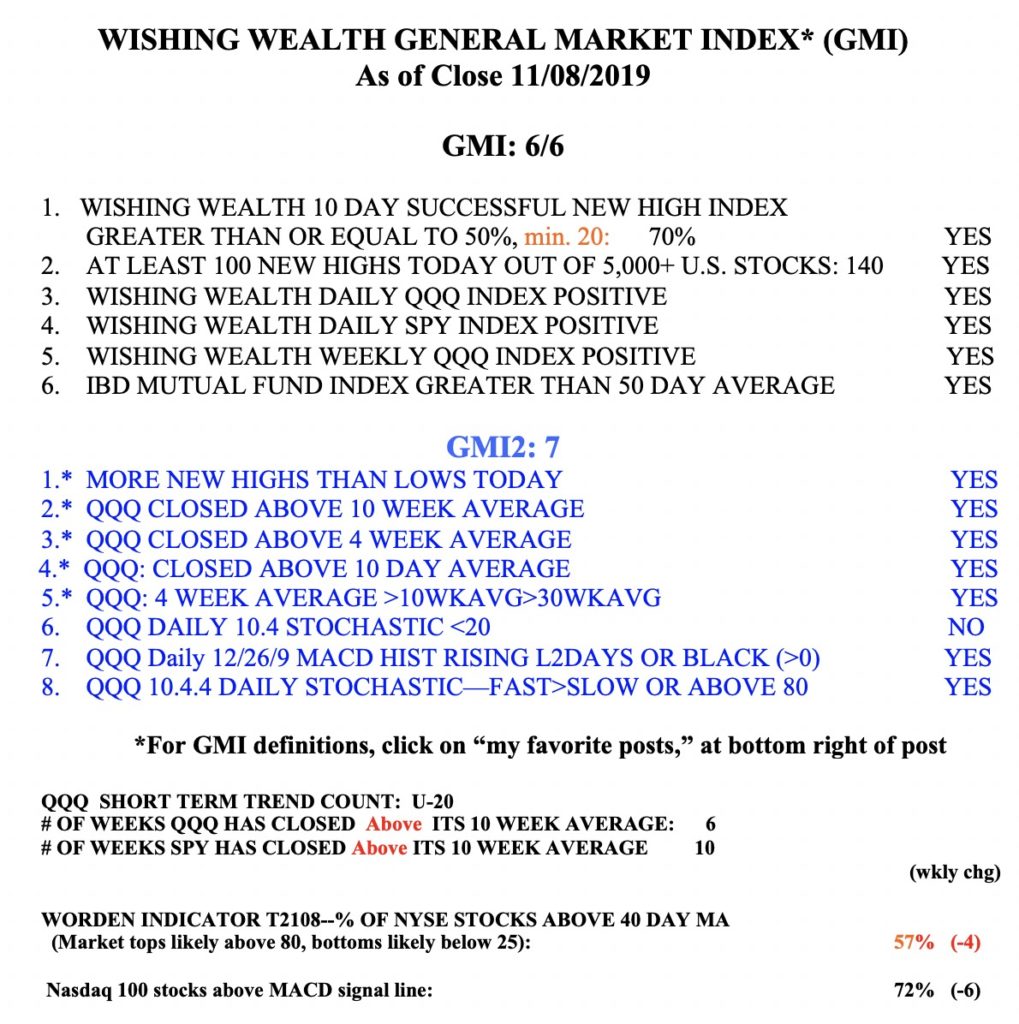

If one had bought TQQQ at the close on October 14 when my $QQQ short term trend indicator identified a new up-trend, s/he would now have a 15.98% gain and outperformed 92% of the Nasdaq 100 stocks and 91% of the S&P500 stocks. Once again, it is clear that buying TQQQ at the beginning of a QQQ short term up-trend can be a highly profitable strategy and frees one from having to find the rare stock that will do better. The GMI turned Green on October 16, and TQQQ has advanced +12.6% since then. To trade TQQQ, which is a 3X leveraged ETF, one must also have a strategy for exiting when the trend turns down. Stay tuned….. (will post again Tuesday night)

I am wondering why your $QQQ short term trend indicator turned bullish on Oct 14 with the EMA15 (188.77) less than EMA30 (188.81)?

I focus on the 30 day simple moving average for that signal.