This weekly chart of the QQQ shows clearly that this index (as well as the DIA and SPY) is still below its declining 30 week average (red line). This is a Stage IV decline. The index has made a nice rebound from the December lows. If the index can close back above the 30 week average and if the red line turns up, it will be time for me to be 100% back in the market. Until then, I take small positions in a few strong stocks and set close stop losses. One note of caution. T2108 is at 84% an extremely overbought level it rarely reaches or remains at.

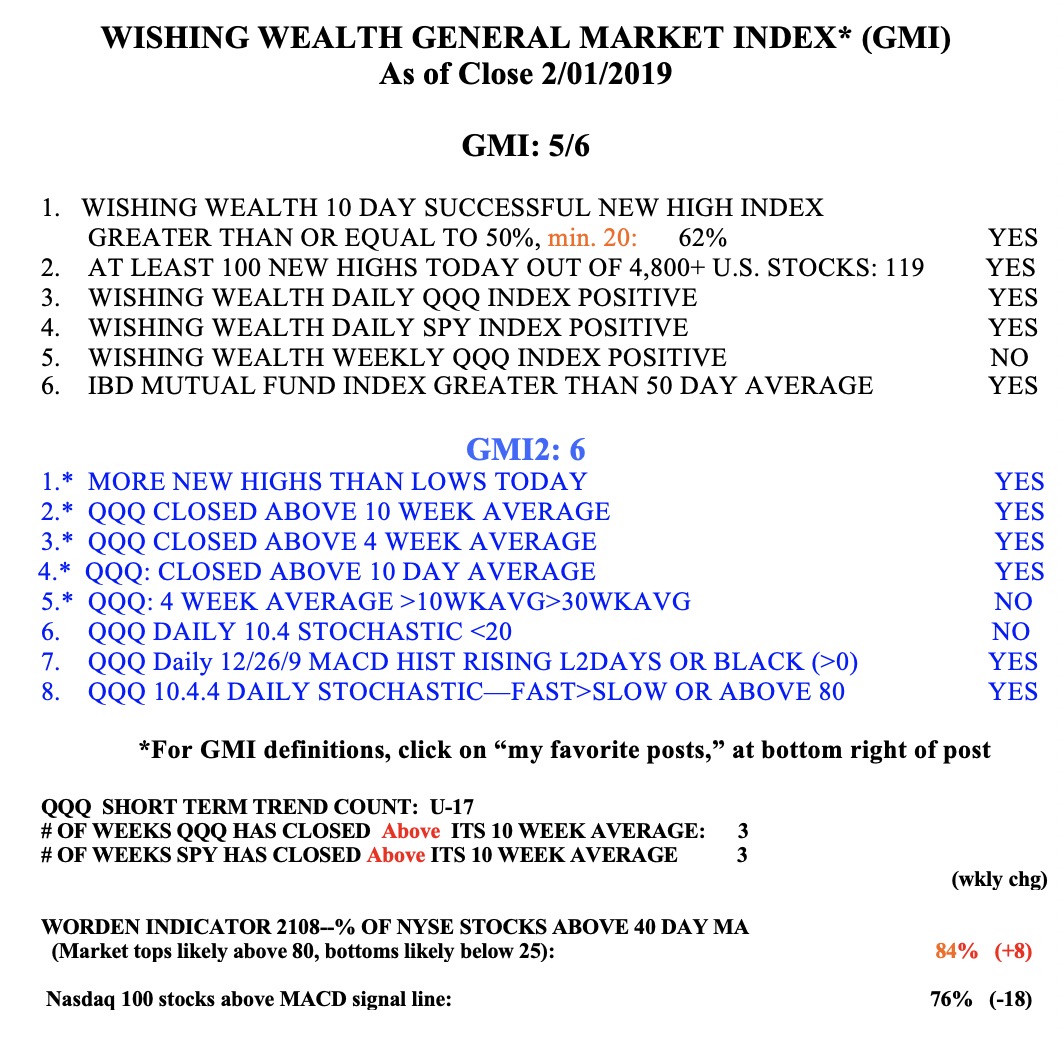

The GMI, at 5 (of 6) is now on a Green signal.

Dr Wish, Thank you for your continuing post, education, and insight you provide daily. I also have greatly enjoyed all the books you’ve recommended to read. I’d had just recently finished reading Stan Weinstein’s book and when you mention it in your blog today I thought I send in a reply. All the books have great nuggets of information, but in the end the message is clear create YOUR plan and stick to your PLAN. Thanks Dana G.