The chart of QQQ’s daily 10.4 stochastics has arrows that show where the fast stochastic (red line) has crossed above the slow stochastic (blue line). That is what I call a green dot signal, also shown on the price chart by, you guessed it, green dots. (A video tutorial for building the green dot signal appears in my TC2000 club.) The green dot is a very short term trend signal on the daily chart of a stock or index in an up-trend and indicates that a bounce is likely. Note that most advances begin after the daily 10.4 fast stochastic has fallen below 50 and then has a green dot. The end of a bounce usually occurs after the stochastic is above 80 (upper horizontal line) and often when it reaches 90 or greater. I therefore think that the QQQ, with Friday’s stochastic reading of 92.67, is overbought and more likely to stall out soon. (QQQ is also near the top of its upper 15.2 Bollinger Band.) I would prefer to place a bet on a rise in the QQQ (or stock) once the stochastic falls below 50 and flashes another green dot signal….

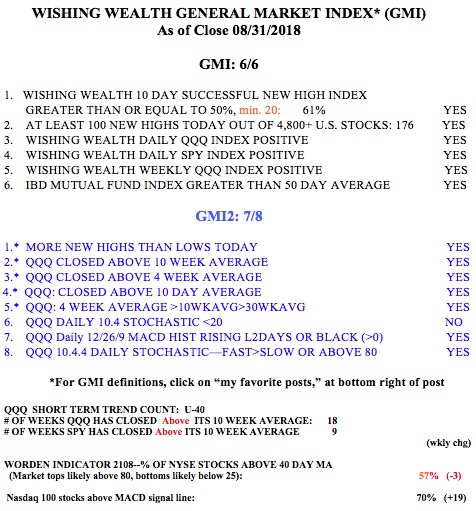

The GMI remains on a Green signal and is at 6 (of 6).

why do you use th 10,4 formula for stoch,s and can you use the same for the slow stoch,s thank you sir