I went to a meeting at my university last week about campus safety. The police captain mentioned a new electronic monitoring system that tracks gun shots. The system was called ShotSpotter. I did not recall this fact until over the weekend when looking at stocks that had hit all-time highs on Friday–ShotSpotter had!!!!! One of the best ways to find potentially strong stocks is during market declines. It is then that the gems stand out in the few stocks that hit all-time highs. So I nibbled at SSTI on Monday and the stock held up very well. It is a recent IPO and has a small float. I do not know if SSTI will do well, but I remember what Taser did in 2003 when the stock went up 7x, formed a green line base and then went up 7x again. I use the chart of Taser (TASR, now AAXN) to teach my students how to trade green line break-outs. Here is the weekly chart for SSTI.

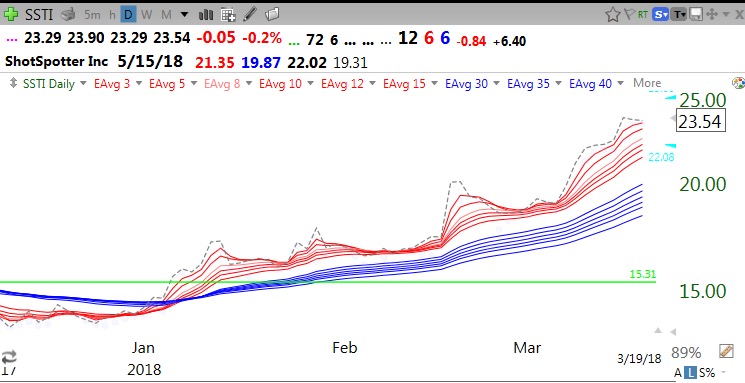

And here is its daily RWB chart–not too shabby! (It was down only $0.05 on Monday in a weak market.)

I think SSTI may be extended right now, but I just want to hold a little for the longer term. I wish we did not need such technology to protect us from snipers.