Perhaps the best example to me of the split between tech stocks and the rest of the market is that T2108 climbed to its highest level since April, while the QQQ continued to break support. T2108, at 65%, measures the percentage of all NYSE stocks that closed above their simple 40 day moving averages. T2108 is computed by Worden software. At the same time that T2108 was climbing, and when 58% of all U.S. stocks rose, only 27% of the Nasdaq 100 stocks advanced on Monday. My GMI (General Market Index), which is heavily weighted toward the QQQ, rose one and just avoided a Red signal. The GMI has helped me to stay on the right side of the market’s trend. It is now in neutral. But the more sensitive GMI-2 is only 1 (of 8). See Sunday’s post each week to view the GMI components table.

Many of my market gurus have written that they shoot the leaders first, and then the troops. With the tech leaders faltering, the rotation into other nontech stocks may be the market’s last gasp? (As Martin Zweig rigorously showed in his book, rising interest rates by the Fed eventually slay the bull.) On the other hand, the market often falls during the post quarterly earnings release lull, only to come roaring back when the next good earnings appear. Thus this decline may be setting up a snap back rally in the tech stocks later in July?

Given that it is impossible to determine in advance what is going to happen and the action of the major indexes, I have retreated in my trading account mainly to cash and am a little short the QQQ with put options. The only stocks I may nibble at are biotechs, which can explode upward on good news. One biotech that came up in one of my TC2000 scans is PIRS. It appears this company has some good partnerships with large drug firms and the fact that it had a recent high volume GLB and is near its all-time high after a recent IPO is impressive to me. I don’t like cheap stocks, but someone is buying PIRS….

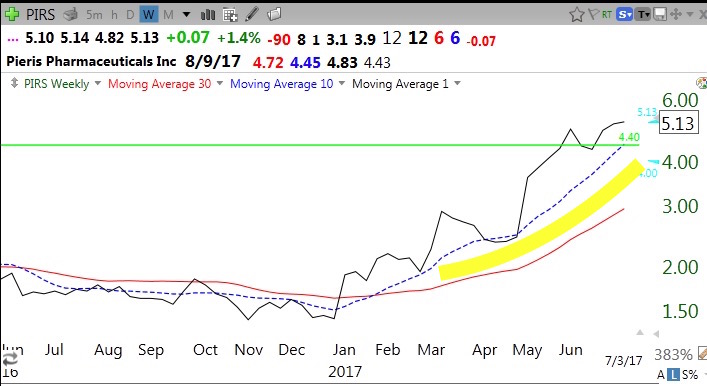

Check out this monthly chart and the weekly yellowband chart.

PIRS also has a nice weekly yellowband rocket pattern. I will hold some PIRS as long as it closes above its green line ($4.40), which is currently near its 10 week average.

Biotechs are very speculative and I only take very small initial positions in them. We need to be extra careful now.

I thought it was the other way around, the troops start to disappear but no one notices because the generals still look strong, then the generals get taken down and everyone becomes aware that market is crumbling?

Yes, it is time to let QQQ go. Price is in the Ichimoku no trend cloud.

PIRS was just added to the Russell 3000 and Russell 2000 indexes. I think that’s where you’re finding some buying–possibly even just index trackers picking up some exposure or active managers now finding this company within their investable universe?

Thank you Dr. Wish for your work and advise. Could you elaborate when time is available on your use of Puts as insurance. I have read your article that is posted, but am still a bit confused about options usage. Sounds like you have it down and would love to read more about it in your commentary. Thanks again.