Most of my readers know that using many of the indicators counted by the GMI (see box at bottom of this page) I was successfully able to stay out of the market during most of the 2000 and 2008 declines. After a bottom was in I reinvested on the long side. The GMI has a very good track record but every time it turns to a Sell does not signify to me that a major decline is beginning. In the past, the 30 week average of the QQQ had to turn down to get me to pull my most conservative pension money out of the market. In spite of the fact that this critical moving average did not turn down in the past year, I mistakenly (in hindsight) took most of my university pension out of mutual funds and put the proceeds into money market funds. The huge increase in my pension account since 2009 together with my fear of losing the gains caused me to ignore my primary rule and to prematurely go to cash. I am back in the market now. I wanted to clarify this situation for my readers, many of whom are interested in knowing what I am doing with my pension account. As one gets closer to retirement, s/he must deal with the fear of losing needed savings versus staying invested. This is a very difficult challenge for boomers who wish to manage their money. I use the GMI and my short term trend count to guide my trading in my most speculative and short term accounts….

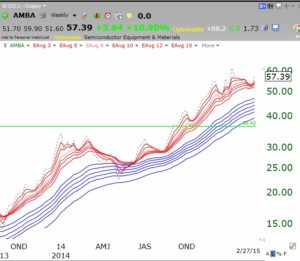

As you know, one of my most celebrated stock gurus is Nicolas Darvas, who made a fortune in two years in the 1950s by teaching himself how to trade. His book (How I made $2,000,000…” is listed to the right of this post and is the first book I assign to my university students. Over the years I have designed an EasyScan in TC2000 that scans all stocks for stocks that I think might have met Darvas’ selection criteria. I ran the scan of almost 6,000 stocks this weekend and it came up with 46 stocks. (I talk about the Darvas scan in my 2012 Houston TC2000 webinar video, whose link is in the green box on this page.) Below is one stock, AMBA, that came up in the Darvas scan and that is also above its recent green line all-time top. This modified weekly GMMA chart shows that AMBA has the RWB pattern and recently broken above all of its shorter term averages (gray dotted line above all red lines). AMBA is worthy of my researching. Note that AMBA is due to report earnings this week, on March 3rd.

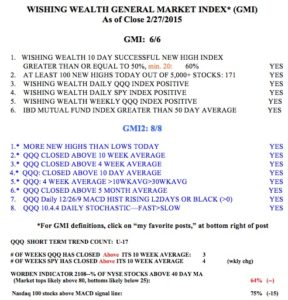

Meanwhile the GMI remains at 6 (of 6) and on a Buy signal.

Thank you for the information on how you use your GMI indicator and have invested your pension account.

On a minor point, Factor 8 of the GMI-2 has changed from Yes to No. The QQQ 10.4.4 Daily Stochastic was 91.33 Fast and 95.52 Slow. Using this criterion, the Factor would be No since Slow is greater than Fast. This has occurred for several days.

Best regards!

Thanks, Rick. I corrected it.