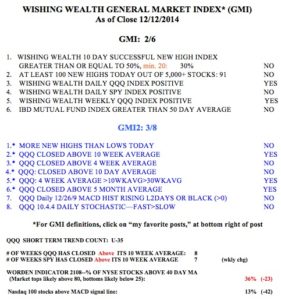

The GMI registered 2 after Friday’s close and will likely be 2 or less again on Monday, triggering a GMI Sell signal. If so, I will close out my few longs and accumulate a leveraged inverse ETF (SQQQ). The T2108 is at 36% and has a long way to fall before our markets are at the level where declines typically end. (See weekly chart below.)

I am very concerned that many of the world’s markets are in free fall and we tend to pretend that the U.S. market is immune from the fall-out. Do we really think that the U.S. economy exists in its own cocoon? Take a look at the recent weekly charts of some of the foreign ETF’s:

TRF: Russia/East Europe:

CEE: Central Europe, Russia, Turkey:

CEE: Central Europe, Russia, Turkey:

Are we worried yet? Or maybe it’s just a benign and temporary oil price precipitated scare….. (would you like to buy a bridge?) I’m not going to wait around to find out. (I have told you I trade like a chicken.)

Are we worried yet? Or maybe it’s just a benign and temporary oil price precipitated scare….. (would you like to buy a bridge?) I’m not going to wait around to find out. (I have told you I trade like a chicken.)

Dr. Wish,

With bearish sentiment, are you thinking an imminent bounce may occur since we are nearing oversold levels on RSI and MACD?

Thanks for showing the charts of the various non-American markets. It really helps to get a good view of what is happening.

Michael in Michigan

dr wish do you use any ipad charting apps?