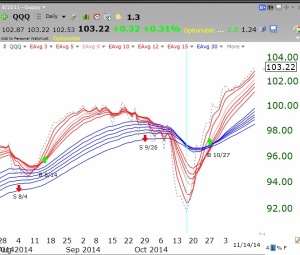

The daily GMMA chart of the QQQ shows the strong current up-trend in this index ETF. The arrows show recent GMI Buy and Sell signals. Note how the short term averages (red lines) constrict when a pause occurs. As long as the shorter term averages are rising above the longer term averages (blue) the up-trend is intact. This is the RWB rocket pattern I like to see on daily and weekly GMMA charts. The black dotted line is a moving average of 1, to show the closing price of the QQQ each day. (My color scheme for the GMMA differs from that used by its creator, Daryl Guppy. )…….

I had noticed the strong up-trend in BITA over the past year (it has tripled!) and wished I had traded it. One of my students alerted me to a nice move in the stock on Friday and I bought some. It looks to me like BITA has broken out of a classic cup and handle pattern. I drew in the pivot point at the high point of the handle. Note the recent all-time high and the huge trading volume on Friday. It remains to be seen whether this break-out will hold. (If it does not, I will exit quickly.) IBD has a nice article about BITA, which it published after it reported earnings last week. At least I will not have to worry about a bad earnings report!

This weekly GMMA chart of BITA shows that it has been in a RWB rocket pattern since early 2013 and had a green line break-out (GLB) to an all-time high in mid-2013. How did I miss such a great move?

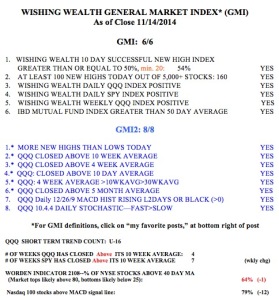

Meanwhile the GMI remains on a Buy signal with all six components positive.