I spent a wonderful morning Saturday presenting a workshop to the DC Metro AAII Chapter. The audience of primarily Boomers was very appreciative of my rather conservative presentation. I stressed the desirability of focusing more on ETF’s than individual stocks in order to lessen volatility and stress levels.

As always, I recalled some points I wish I had made. First, all should investigate the use of U.S Government I-bonds for ultra safe money. These are U.S. savings bonds that adjust every 6 months to the level of inflation. Thus they are very safe and their yield will rise if interest rates do. They will not fall in value like regular bonds can when rates rise. Read all of the rules on I-bonds here. I believe they are better than CD’s or savings accounts. The current yield is 1.38%

I also wanted to tell new readers that they can have the GMI stats mailed to them every day by entering their email address in the box to the right of this post. I do not release your email address to others. The box by which to subscribe looks like this:

You may also view my Houston TC2000 webinar from 2012 by clicking the link to the right side of this page.

You may also view my Houston TC2000 webinar from 2012 by clicking the link to the right side of this page.

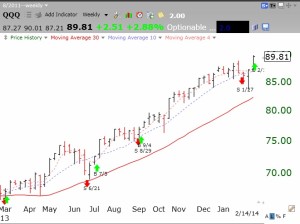

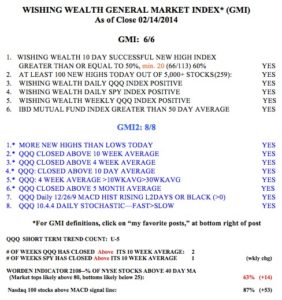

As to this market, all of the indicators in the GMI and GMI-2 are positive. Furthermore, the GMI flashed a Buy Signal on 2/12. Friday was also the 5th day of the new QQQ short term up-trend. The longer term up-trend is very intact. Look at the Stage 2 up-trend in the weekly chart of the QQQ. The QQQ is nicely above it rising 30 week average (solid red line).

Hopefully this nonsense about the Dow chart looking similar to its chart from 1929 has dissipated. This market looks no way like the one in 1929 leading up the the great crash. But the market climbs a “wall of worry” so bring on the whiners. I will become concerned when the pundits start saying that the market has nowhere to go but up….

Hopefully this nonsense about the Dow chart looking similar to its chart from 1929 has dissipated. This market looks no way like the one in 1929 leading up the the great crash. But the market climbs a “wall of worry” so bring on the whiners. I will become concerned when the pundits start saying that the market has nowhere to go but up….

I have been talking about a bottom in gold (GLD ETF) for several weeks. Last week GLD closed back above its 30 week average for the first time since January, 2013. I think it is early, but we might be seeing the beginning of a Stage 2 up-tend. I have been buying GLD and writing weekly calls on the position. The return is about 3% per month on my investment. Check out this weekly chart of GLD. Note the double bottom around 114.50 and the flattening 30 week average.

Finally, TSLA had a green line break-out last week. It will be interesting to see if the stock surges after earnings are released this week.

Finally, TSLA had a green line break-out last week. It will be interesting to see if the stock surges after earnings are released this week.

Here are the GMI stats: (click on to enlarge)

Nice to have you back, Eric, and to hear that the conference went so well.

Here is an idea (not original with me; I borrowed it from Frank Grossmann) that might be of interest to other followers: Instead of simply going long TQQQ (or QLD, QQQ,etc.) on a GMI buy signal, go long TQQQ with 80% of your allotted capital, and go short TMV with the remaining 20%. With a monthly rebalance, the results are better than with a 100% TQQQ investment, and the drawdowns considerably less.

As always, I’m very grateful for the work you choose to share with the public.

I heard about the comparison to the 1929 chart and someone was talking about a 40% correction. But similarity does not necessarily equate to magnitude. A lot of analysts were talking about a 10% correction which I was hoping for as it would flush out a lot of weak hands and set us on track for the next leg up. Given that we only got a 6% correction, I’m not sure if there isn’t another downside lurking.

What is the method you use for getting into a position after your buy signal and also after the trend has exceeded 5 days? How many buys do you make before achieving a full position and when do you add to your position? Or do you go all in at once? Thanks so much.

I do not give out any formula. Everyone must decide the level of risk they want to take on and the time to build a position.