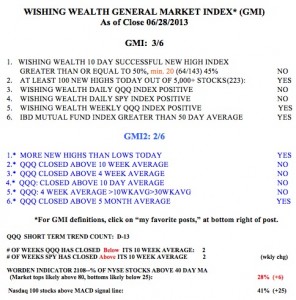

The GMI remains on a Sell signal since 6/21. IBD still sees the market in a correction. It has been 13 days since my QQQ short term trend indicator turned down. The last time we had a longer short term down-trend in the QQQ was the one that lasted 33 days and ended last November. No one knows how long this down-trend will last, or if the longer term trend will turn down. With the second quarter mutual fund window dressing period now over, it remains to be seen if the recent bounce is over. I suspect it may be, although the Worden T2108 Indicator did fall mid-week to a low of 13.1%, a very oversold level where the bottom of a decline sometimes occurs. T2000 now computes T2108 throughout the trading day, so I can get intraday readings for T2108, instead of just the daily closes. Even AAPL bounced on Friday, a sign that even the weakest stocks may have finally participated in the rebound. If the decline resumes on Monday, it could be rather steep. I should be ready to respond, but must not anticipate a move that may not materialize. I am a trend follower……..

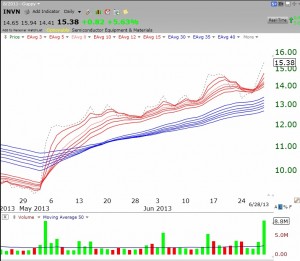

Meanwhile, INVN, another stock that my wise stock buddy, Judy, likes (and I own) had a high volume advance on Friday. INVN has exciting motion sensor technology that is important to smart phones and rumors are flying whether their products will be contained in a possible new, cheaper iPhone. Look at this RWB daily Guppy chart with its beautiful high up-volume (green) spikes. Somebody big is buying.

I am losing my confidence in IBD, which missed the market direction in the last 3 times they published its direction change. They were late in stating the last downtrend. Now by the time they write “market in uptrend” it will be time to sell. So, if we do the opposite you can do well in the market. BTW, I have held my INVN for months, bought long ago and paid $9.75 per share — almost 100% profit and will sell when it doubles that.