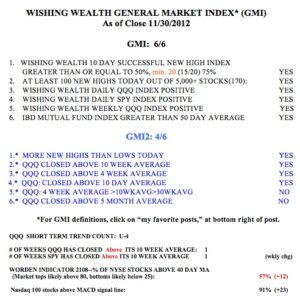

It is never a good idea to fight the trend of the general market. With the GMI flashing a recent Buy signal and the QQQ short term up-trend likely to reach its 5th day on Monday, it is time for me to accumulate TQQQ. I also own some FB, which I will hold long term. FB rose 16% last week on relatively high trading volume. The QQQ and SPY have now closed back above their 10 week averages, a good sign of strength. I have a much better chance of making money on the long side when this is the case.

Speaking of making money, I wanted to remind my readers to look into government I bonds. These U.S. savings bonds are paying 1.76% and are a great way to earn more interest than one can get on a CD. I bonds have their interest rate adjusted each 6 months in accordance with the CPI-U. Therefore, unlike CD’s, the interest paid climbs if interest rates should rise. There are a number of rules regarding I bonds and one should read them carefully. For money being saved for 1 or more years, they represent a terrific option to me.

The myth behind leveraged ETFs:

http://www.marketwatch.com/story/the-myth-behind-leveraged-etfs-2012-11-29