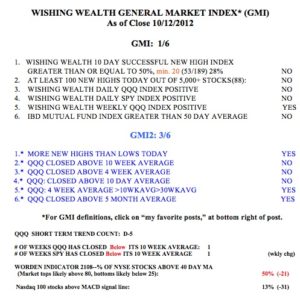

I monitor an oversold indicator which counts 4 things. The reading is now 3 (of 4). I suspect we will get a bounce very soon. However, with the GMI at 1 (of 6) and on a Sell signal and with IBD saying the market is in a correction, it is not time for me to re-enter this market in my trading accounts. The market, however, remains in a Stage 2 Weinstein up-trend, so I am leaving my university funds in invested in mutual funds for now. If the GMI reaches 0, I will begin to take some of that money off of the table. In a prolonged bear market, the T2108 will reach 15% or lower and it is currently at a neutral 50%. But Friday’s put/call ratio was just over 1.0, a sign of a short term very oversold market ready to bounce.

Would you be willing to share what the oversold indicator is?

I thought the Worden T2108 percentage indicated overbought and oversold, which now stands at about neutral???