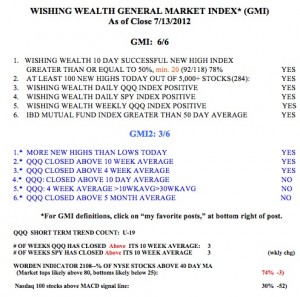

The GMI rose to 6 on Friday and the GMI-2 to 3. However, IBD still labels the uptrend under pressure. Friday’s rise came on lower volume and the market seems indecisive. The SPY is still above its critical rising 30 week average (red line) and in a Weinstein Stage 2 up-trend. However, the indexes have whip-sawed above and below this important average recently. The market is not out of the woods yet.  I am struck by the similarity in the pattern of the SPY to that of last year, highlighted in yellow on this weekly chart. The SPY peaked in May, 2011 and then came down below its 30 week average and climbed back above. And then the market decline resumed. In 2011 and now, the SPY’s 10 week average (blue dotted line) fell below the 30 week average. If last week’s rebound fails to hold the 30 week average, we could be in for a similar multi-week decline. I am therefore mainly in cash and will wait for the market to tip its hand. With a lot of stocks reporting earnings this week, we shall learn a lot by how the market reacts to specific announcements……..

I am struck by the similarity in the pattern of the SPY to that of last year, highlighted in yellow on this weekly chart. The SPY peaked in May, 2011 and then came down below its 30 week average and climbed back above. And then the market decline resumed. In 2011 and now, the SPY’s 10 week average (blue dotted line) fell below the 30 week average. If last week’s rebound fails to hold the 30 week average, we could be in for a similar multi-week decline. I am therefore mainly in cash and will wait for the market to tip its hand. With a lot of stocks reporting earnings this week, we shall learn a lot by how the market reacts to specific announcements……..

In spite of the recent whip-saws and near misses, the QQQ has completed the 19th day of its short term up-trend. The T2108 is at 74%, down from 81% and not in overbought territory. But only 30% of the NASDAQ 100 stocks closed with their MACD above its signal line. This reflects short term weak momentum in tech stocks. The GMI buy signal remains in effect since June 19.

I hope to see many of you at my AAII workshop on July 21. Many people have asked me to share with them the material that I offer to my undergraduate honors students. This will be your opportunity to get a good overview of my course.

I was hoping that you might consider making the workshop material available to those of us that are unable to attend.

I will prepare more videos in the future.

Hey Dr. Wish I like the point you made about repeating patterns. I might adding that the pattern has developed in a lot less time than the one previous, which tells me that the rally that we might see will be contracted and take less time to unfold than the previous one. I am a 200% in agreement.

Thank you for the excellent commentary and analysis. I too wish that there was some way to have access to the materials that you will present at the AAII workshop in Alexandria, Virginia. It is too far away for me to attend.

I don’t see it

The moving average 100 rate of change has turned negative. This is rarely a good sign.