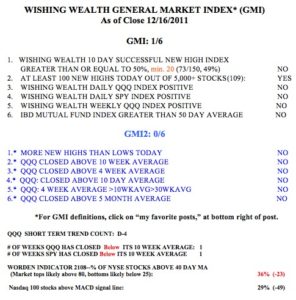

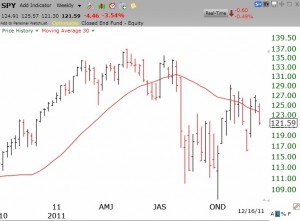

Friday was the 4th day of the current QQQ short term down-trend. Only 29% of the Nasdaq 100 stocks closed with their MACD above its signal line and both the SPY and QQQ have closed below their critical 10 week averages. I am in cash in my trading accounts and will start moving out of mutual funds and into money market funds in my university pension. The longer term averages appear to be continuing Stage 4 declines. The weekly chart of the SPY (S&P 500 ETF) shows it to be back below a declining 30 week average (red line). This is a very ominous pattern. The QQQ has a similar bearish pattern.

Only 29% of the Nasdaq 100 stocks closed with their MACD above its signal line and both the SPY and QQQ have closed below their critical 10 week averages. I am in cash in my trading accounts and will start moving out of mutual funds and into money market funds in my university pension. The longer term averages appear to be continuing Stage 4 declines. The weekly chart of the SPY (S&P 500 ETF) shows it to be back below a declining 30 week average (red line). This is a very ominous pattern. The QQQ has a similar bearish pattern.

Dr. Wish – I just wanted to say I am new to your blog. I have read many of the weekly blogs in the last day. The GMMA chart is outstanding. I have set it up on QCharts at home and you can easily see what to do given the weekly table info says it is not a good time to go long. I also have done options in the past so I may try them again using the GMMA daily chart. What I wanted to ask is whether you use the TC2000 to create the GMMA charts. QCharts has gotten way to expensive and I am looking for another charting service which does what I need it to do. I look at the video tutorials and found them helpful. Now if the TC2000 can be used to create a GMMA chart I believe I will switch. Thank for your feedback in advance. Jack