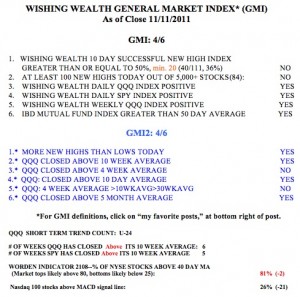

While this market has shown extreme volatility, the indexes are remaining above their key daily and weekly moving averages. A few more good days could yield the powerful 4wk>10wk>30wk pattern on the QQQ. If only AAPL would come to life! A major signal for caution I see is that the Worden T2108 indicator is very extended, at 81%.

Meanwhile, my new high+great earnings scan yielded 13 hits out of more than 5,000 stocks: QCOR, ASPS,SWI,ORLY,MA, CASY,DCI, FAST, CVLT,SXL, AZO, NSR, MANH. Any stock with good earnings that can come through the market of the past year at new 52 week highs is worth researching. All of these but NSR are also at multi-year highs.

SXL came up last week on one of our Livermore style scan for stocks trading around par with potential to break out to the upside. If I recall your old posts correctly, SXL may have met the characteristics of a 20+ point mover when it broke to the upside Mid Sep.

Cup and Handle is forming on JOSB, looks very nice and tight on the weekly chart. What do you think? I am weighting for a breakout

Thanks to share this useful stock information.