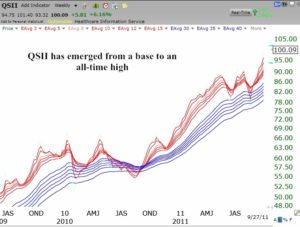

The market continues to recover, with the T2108 well into neutral territory. It remains to be seen whether the market can break through its longer term averages. Meanwhile, the GMMA monthly chart below shows that QSII has emerged from a multi-month base. Judy and I have been talking about QSII for some time, and I currently own some of QSII. (Click on chart to enlarge.) With the GMI at 1, I remain very cautious.

For What its worth-quoted comment by a trader who has not taken your course but publishes a “Short Report” newsletter:

“One trader who isn’t panicking is our own Jeff Clark. Today, he updated his S&A Short Report readers on how he expects the stock market to play out over the next several weeks. Jeff expects one last major “shakeout,” followed by a big rally through the end of the year. He notes…

… It looks to me like the odds favor a strong move to the downside starting soon. There’s an old saying on Wall Street, “Sell on Rosh Hashanah and buy on Yom Kippur.” This saying highlights the seasonal weakness that often occurs between these Jewish holidays. The market doesn’t sell-off every year. But it happens often enough for there to be a saying about it.

Today is Rosh Hashanah. Yom Kippur is October 7. So for the next week and a half, the seasonal trend is bearish. The stock market is already highly charged over the headlines coming out of Europe. Investors are skittish over the market’s recent volatility. The Volatility Index is persisting at elevated levels. And, the global markets are coming unglued.

These are the types of conditions that often lead to exhaustive and capitulatory declines. We’ve been waiting for a move down to 1100 or lower for the S&P 500. If it’s going to happen, then I can’t imagine a better time than now for it to occur.

Jeff thinks the chance of a big decline over the next few weeks is high.”

This is a day trader market. It’s not a buy for long term and sell if dips 8% from your purchase price. If you do this, you’d be losing 8% in every stock purchase!