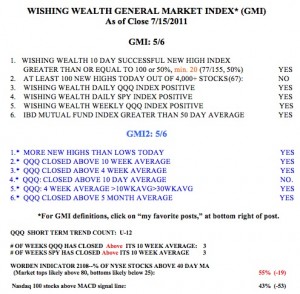

In spite of all of the bad news about raising the debt ceiling, the up-trend continues. With the GMI and GMI2 each registering 5 (of 6), I must respect this up-trend.  I do not think we would be seeing such buying in GOOG or AAPL if this market were going to enter a prolonged down phase. I began worrying about the tech stocks when AAPL could not go to a new all-time high. But it did so on Friday after consolidating for 20 weeks, and GOOG climbed almost 13% ($68). The bulls are still alive. The Worden T2108 indicator is at 55%, in neutral territory. The QQQ and SPY have spent 3 weeks back above their 10 week averages. And the QQQ now has the strong 4wk>10wk>30wk averages pattern. So, I am slowly wading back into this market.

I do not think we would be seeing such buying in GOOG or AAPL if this market were going to enter a prolonged down phase. I began worrying about the tech stocks when AAPL could not go to a new all-time high. But it did so on Friday after consolidating for 20 weeks, and GOOG climbed almost 13% ($68). The bulls are still alive. The Worden T2108 indicator is at 55%, in neutral territory. The QQQ and SPY have spent 3 weeks back above their 10 week averages. And the QQQ now has the strong 4wk>10wk>30wk averages pattern. So, I am slowly wading back into this market.

Hi Dr. Wish,

I agree that AAPL has broken out of a 20 week range, but what concerns me is that the general market on the weekly chart (Nasdaq, Dow and other indexes) are topping and they look bleak as improper double bottoms are lookin like they are going to fail and head and shoulder patterns are becoming evident on the charts. Thanks for your feedback.

You are a genius Dr! I followed your advice and today (July 19) I’ve made 20%. 20% in one day!!!

Professor,

I agree. What are your thoughts on ISRG?

Eliot

Fantastic info! I have been seeking something such as this for a little bit now. Thank you!