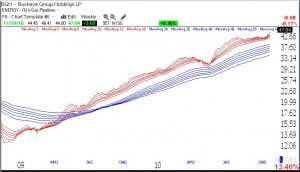

With the rise in the price of commodities, and especially oil, a lot of oil and gas related stocks hit new highs on Wednesday. Twenty of the 173 stocks in my universe of 4,000 stocks that hit a new high on Wednesday were in the oil and gas industry. Of these stocks, 5 were also on my cumulative IBD100 or New America watch lists : SPN, BGH, SXL, EPB and INT. All of these stocks have the important RWB pattern typical of launched rockets. A GMMA weekly chart of BGH appears below as an example. All of the short moving averages (red lines) are well above the rising long term averages (blue), with a white space separating them.

Dr Wish, what do your charts show about AAPL? I entered at $160 and again at $200. It has had a good run up and I am thinking abt leaving it with a new stop loss placed today, even if it corrects more. Hope you also enjoyed its climb to $320! thanks

Dr. Wish, I wanted to get you opinion on what percent of of your investment funds do you invest in a give stock position. William O’ Neill seems to think it’s better to only hold a few positions and not over-diversify. I wanted to get your take. Thanks.

I agree with O’Neil. I concentrate my funds in strong stocks but never put more than 20% in one position, except with index ETF’s. I pyramid up slowly.