IBD said tonight that Wednesday’s rally was a follow-through day on a new market up-trend. William O’Neil, publisher of IBD and successful trader, has written that all market bottoms come after a follow-through day. However, not all follow-through days succeed. According to my criteria, we are a long way from a change in trend. Yes, we got a bounce from a very oversold condition, with the stochastic on the major index ETF’s near zero. We will just have to wait to see if this rally has legs. For now, Wednesday was the 8th day of the current QQQQ short term down-trend. The GMI remains at zero, but the more sensitive GMI-R moved up to one.

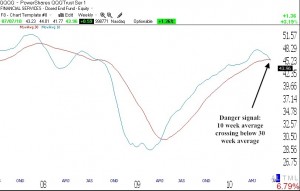

I may be wrong, but today I moved the rest of my university pension funds from mutual funds to a money market fund. I was hoping for a rally that would allow me to sell out at a higher level, and seized the opportunity today. If I am wrong and the major indexes resume an up-trend, I will move back into stocks, but it will take a strong up-trend and a GMI reading above 4 to convince me. Take a look at the bearish signal in the weekly chart of the QQQQ below (click on chart to enlarge), where the 10 week average (blue) is crossing below the 30 week average (red). In an up-trend the reverse happens.

You can catch my next Worden webinar on August 24 at worden.com. My first webinar is also stored there, scroll down to “A word from the professor.” Contact me at: silentknight@wishingwealthblog.com

From a fundamental/economic standpoint its also looking fairly bleak. Some economic analysts have revised their projected growth numbers downwards. Taxes will go up next year, no new economic stimulus coming down the pipeline, and there currently just are not jobs out there for people. Something needs to spur growth, but there does not appear to be anything on the horizon.

I also am in cash as I believe right now there is too much risk that exists in current market conditions to predict movement one way or the other.

Did you drop your shorts? )

A market this volatile tricks many into interpreting trends.

Bounces are expected. This one is on low volume.

We’ve had similar white bar days on 5/21, 5/25.

Current downtrend started 4/27, and we are still in it.

I’m disappointed with IBD calling this a FTD.

How funny is it that IBD just broke one of its own rules. According to the book “How to Make Money in Stocks”, a follow through day is considered only when the volume is above average. Yesterday’s volume was low. How can IBD call this an FTD?

They now say the volume must be higher than the preceding day. But day one was supposed to be the start of a rally, not a reversal day that closed down!!?? Regardless, we must just wait to see if they are correct about an up-trend.

If what you say is correct, then I did well in moving ALL my pension funds into money market back in MAY 2010 !! And you just moved yours now!?