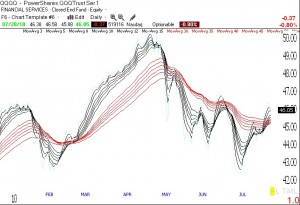

One reader questioned my writing that “the train has left the station” a couple of days ago. I think I was too early in my call. I like to describe the trend and not predict it. Furthermore, I write often that when I think the trend has changed, I wade very slowly into the market. I remain largely in cash right now. There were less than 100 new 52 week highs in my universe of 4,000 stocks on Wednesday and my weekly QQQQ trend indicator is now negative. This is why the GMI declined 2 points. While my short term trend indicators remain in up-trends, the longer term trend is flat. It is too early to call a new long term up-trend. We are still in a market fraught with whip-saw moves, not one for me to be heavily invested in. The chart below shows the daily GMMA for the QQQQ. Note that some of the short term averages (black) are now above the longer term averages (red). Only time will tell if this is the beginning of a multi-month up-trend like the one that began last March.

The market nowadays does not behave like that in Darvas’ times… simply because technology changed and EVERYONE now has access to market news immediately, even before it is printed. Everyone now has their own stock account and does not depend on news or broker. Therefore, many Darvas’s strategies are obsolet. Don’t you agree?

I do not agree. Human psychology, how people react, is the same as in Livermore’s time in the early 1900’s. The techniques developed by these great traders still work for me.