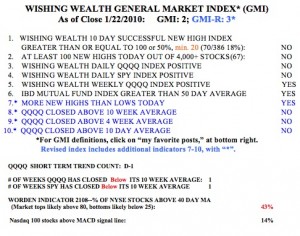

The vicious high volume break in the tech stock short term up-trend is a major sign of weakness. The GMI is down to +2, for the first time since the decline last November. This is not the time to be brave; I must conserve my capital. I will lighten up this week, move up my sell stops, and wait to see if the decline deepens. Given that the longer term up-trend remains intact, I will not go into cash in my conservative university pension funds.

Note that there were few (<100) new highs on Friday and that the T2108 indicator is now down to 42%. Only 14% of the NASDAQ 100 stocks had their MACD above its signal line. There were only 67 new highs in my universe of 4,000 stocks on Friday…… For several weeks I have been talking about the upward channel that tech stocks (TYH) have been in. I noted when tech stocks were near the top of the channel that it was time to hold back a little. I also said that I would wait for a bounce off of the bottom to buy stocks again. However, the bounce did not come. Instead, as the chart below shows, the channel was broken on Friday. Major tech stocks like AAPL, CSCO, and MSFT declined on high volume Friday. I am therefore very cautious.

Only 14% of the NASDAQ 100 stocks had their MACD above its signal line. There were only 67 new highs in my universe of 4,000 stocks on Friday…… For several weeks I have been talking about the upward channel that tech stocks (TYH) have been in. I noted when tech stocks were near the top of the channel that it was time to hold back a little. I also said that I would wait for a bounce off of the bottom to buy stocks again. However, the bounce did not come. Instead, as the chart below shows, the channel was broken on Friday. Major tech stocks like AAPL, CSCO, and MSFT declined on high volume Friday. I am therefore very cautious.

Hi Dr. Wish, I remember in an earlier post you said that the trading style you use in your pension was actually better suited to this rally because you didn’t get shaken during any of these dips. Are you using this analysis in any way to change the way you trade in your IRA?

I am a chicken with my trading IRA and go to cash more quickly there than I do with my university pension mutual funds. My university pension limits the number of trades I can do.

Dr. Wish,

I’m an avid reader of your blog and have been for several years dating back to when I took your class at UMD. I wanted to reach out to you to see you have suggestions for other blogs, websites, books, etc. that you think are great resources to follow. Thanks for your great posts and for your help!

I don’t wish to be highly critical as I really like your approach, but could you reprise your comparison of TYH vs QQQQ. I believe that in a single day it more than lost all its advantage since the uptrend began. I’m not convinced it has any advantage, it is just more volatile and during volatile periods it tends to underperform. That said, you might find it costs you a little in the weaker trends, but pays off handsomely in the rarer, longer trend.