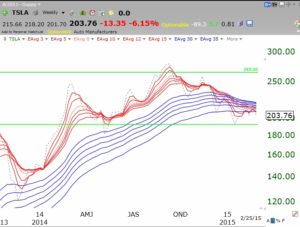

TSLA has a troubling GMMA chart.

Share this:

- Click to email a link to a friend (Opens in new window) Email

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to print (Opens in new window) Print

- More

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

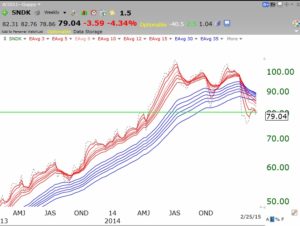

again out of curiosity…

TSLA, from 10/14/2011 (when there is enough data for the long EMAs):

RWB*: Profit 495%, MaxDD 36%

(buy when short EMA above all long EMA, sell when short below all long)

RWB**: Profit 454%, MaxDD 36%

(same buy rule, but sell when the short EMAs are under the just the highest long EMA)

B&H: Profit 626%, MaxDD 36%

For SNDK:

RWB*: 254%, MaxDD 84%

RWB**: 242%, MaxDD 83%

B&H: Profit 1755%, MaxDD 93%