IBD sees the market in a correction and the GMI could flash a sell signal this week. We normally see strength as earnings come out, followed by a post-earnings lull. But look what happened to IBM on Friday after it announced earnings.

The only technical tip off I might have noticed (I did not own IBM) is that it failed its recent green line break-out several times. When a stock bursts through a multi-month green line base to an all-time high, it should not look back much. IBM closed below its green line top on several occasions. If the market is weak during earnings season, what will happen during the following, typically weak period?

A reader asked me if gold or silver are good buys now. As you know, I only buy stocks or ETF’s that are near or above their green line tops. I do not buy stocks that have been much higher and declined. There are so many people waiting to sell as the stock comes back, and one never knows if the decline will resume. A failed come back rally can lead to a quick, vicious decline. GLD is now below 2 of its green line tops. It is not my game to buy it or silver, which has a similar pattern. Look at this monthly chart of GLD. Would it not be better to buy it, or any stock, when it is breaking above a green line top? A failed green line break-out is a major sign of weakness.

AAPL had a green line break-out failure last September and just penetrated a former green line base.

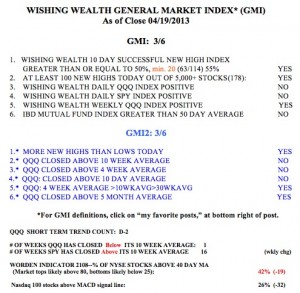

Meanwhile, the GMI strengthened to 3 on Friday and remains on a buy signal since late February. Nevertheless, this market has been very difficult for me to trade profitably. I am largely in cash in my trading accounts. I am prohibited from market timing with the mutual funds in my university pension but will consider transferring a portion to money market funds if a serious down-trend looks imminent. I am unwilling to take large risks with my retirement assets.

Note that the QQQ is back below its 10 week average and the IBD Mutual Fund Index is now below its 50 day average. When these technical events occurred in the past, I was unlikely to make money trading growth stocks. If the fund pros can’t do well trading growth stocks, neither can I. Friday was day 2 (D-2) of the new QQQ short term down-trend. I trust short term trend changes more after they reach day 5. Only 26% of Nasdaq 100 stocks closed with their daily MACD above its signal line, a sign of near term weakness.

For those of you who are brave and/or foolhardy, there were 7 stocks that came up in my TC2000 scan for stocks at new highs with good recent earnings.  ACOR just broke its green line top and several of these recently broke through their green line tops. Any stock that can come through the recent market volatility at an all-time high is a good company to start researching. Many such stocks are extended and probably should be monitored for a pull-back to support. When I search for stocks to buy, I always start with the new high list.

ACOR just broke its green line top and several of these recently broke through their green line tops. Any stock that can come through the recent market volatility at an all-time high is a good company to start researching. Many such stocks are extended and probably should be monitored for a pull-back to support. When I search for stocks to buy, I always start with the new high list.

It’s over for gold:

http://blogs.decisionpoint.com/chart_spotlight/2013/04/20130419cs.html

http://markdow.tumblr.com/day/2013/04/15

Just wanted to say thank you!

I read your blog everyday….very helpful in understanding the market!

Best,

Scott.