ONVO, a highly speculative one of “Judy’s Picks, ” has been on a roller coaster the past two weeks. This article provides more information about why this company is so interesting. I am holding some ONVO long term just in case the firm’s bio-printing business becomes profitable. The two other major 3D printing companies, DDD and SSYS, have been or quite a run….

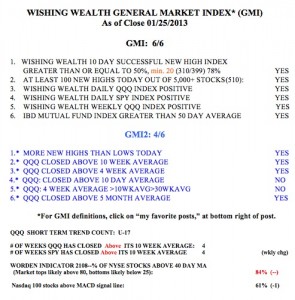

The GMI has been at 6 (of 6) for 17 straight days. During this time the SPY has advanced +2.87%, the DIA +3.73% and the QQQ +0.22%. Clearly, tech stocks as measured by the Nasdaq 100 index, have underperformed during this rally. This is largely caused by the overweighting of AAPL in this index. AAPL has declined -17.3% during this same time period. I am a little cautious with the T2108 at 84%. While T2108 does not stay so high for a long time, the market can continue to climb for some time after the T2108 peaks. So I am not too concerned yet. However, after earnings come out there will likely be some retracement. The fact that over 53% of investment advisers are bullish and only 22% are bearish is another concern that this rally may be getting old. The Investors Intelligence poll is a trusted contrary indicator. When most advisors turn bullish it is nearer to the end of a rise.

JUDY, you and I are sitting pretty with our INVN shares. Even IBD started to mention it today. I may even buy more shares. When I bought INVN a few months ago, Dr. Wish said he would become interested when INVN reaches $22/share, which was its highest point months ago. In my view, INVN is forming a cup now, and the cup shall runneth higher soon!

ONVO is an interesting company, boasting an interesting technology. “However, growing functional organs is still at least 10 years away, said Shaochen Chen, a professor of nano-engineering at the University of California, San Diego, who uses bioprinting in researching regenerative medicine.” http://www.cnbc.com/id/49348354/How_3D_Printers_Are_Reshaping_Medicine

Lets be honest, the FDA does not like to let technology advance quickly. So if the FDA approval is needed, I’d speculate this technology is 10 years out based on trials alone.

This sounds good as a long term speculative play, but short term where will this company benefit? Two answers seem to be in patents (i.e. a larger company buys them for their patents). The second answer is the same that all 3d printing has been benefiting from: creating value for bigger companies. If printed organs will help the testing of new pharmaceuticals, then I’d expect the company to get major business with companies like Pfizer.