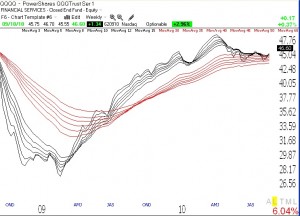

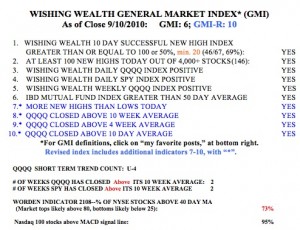

The QQQQ up-trend continues and all of my indicators are now positive, with the GMI at 6 (of 6) and the GMI-R 10 (of 10). The QQQQ and SPY indexes have now closed above their critical 10 week averages for the second straight week.  In addition, 95% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. The Worden T2108 indicator is now 73%, which is near overbought levels, but it can remain there for months. With options expiration coming at the end of this week and the end of the 3rd quarter with mutual fund window dressing at the end of the month, we could see a nice rally. I know everyone fears the market in October, so we may get some turbulence in October before earnings come out. Still, I am accumulating stocks , given the strong GMI reading. In addition, the GMMA weekly chart of the QQQQ (click on chart to enlarge) shows the averages holding their own. The shorter term weekly averages (in black) appear to be slowly rebounding off of the longer term averages (in red). Check out the column to the right to see the types of stocks I am trading.

In addition, 95% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. The Worden T2108 indicator is now 73%, which is near overbought levels, but it can remain there for months. With options expiration coming at the end of this week and the end of the 3rd quarter with mutual fund window dressing at the end of the month, we could see a nice rally. I know everyone fears the market in October, so we may get some turbulence in October before earnings come out. Still, I am accumulating stocks , given the strong GMI reading. In addition, the GMMA weekly chart of the QQQQ (click on chart to enlarge) shows the averages holding their own. The shorter term weekly averages (in black) appear to be slowly rebounding off of the longer term averages (in red). Check out the column to the right to see the types of stocks I am trading.