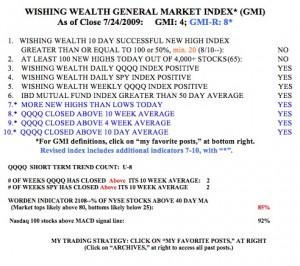

The up-trend continues but the T2108 is at 85%, about as high as it gets. That does not mean we will get a decline, for it can stay above 80% for weeks. I went to an investor’s group meeting this weekend and was amazed to find that many sophisticated investors are resisting this rally. About two thirds expected an imminent market decline. I am incredulous that people would rather fight a trend than ride it. If one puts in stop losses to control risk, why not ride the market until it falters. No one can consistently know when a trend will end. Stop guessing! Meanwhile, the GMI

is at 4 and the GMI-R is at 8. 92% of the Nasdaq 100 stocks closed with their MACD above their signal line. We had one day last week (Thursday) when 130 stocks in my universe of 4,000 stocks hit a 52 week high. The last time we had 100 new highs was on September 19, when we had 319.

I am now 75% invested in mutual funds in my university pension plan. I am also holding some deep in the money call options in QLD in my trading IRA. There are a number of stocks at or near all-time highs that I am interested in watching, including: OTEX, GMCR, RKT, ISH, JJSF, ARO, HMSY, DORM, NTES, STEC, TTEK, DLTR, MNRO, EW, ROST, SY, ORLY, AAP, ATNI, CERN, SNX, MVL, QSII, TEVA, and RMTI. Some of these stocks will probably be real rockets as the up-trend continues.

I have to agree the trend is up and stronger than I expected. 91 new highs on the NASDAQ today. I guess we are all nervous including myself that it will break down in the matter of days/hours and break down hard. At this point, I am very concerned about 41 on the QQQQ. I see this as resistance based upon a low prior to the meltdown on 3/21/08. I am also concerned about the trend line that starts back in 2000 and touches the top at 11/2007 & again in 6/2008. For over a decade we cannot get past that line and that line intersects at 41. I also think 41 is a nice intersection with the top of the channel that we have been riding up since march. I certainly cannot predict a turn although I know it will happen eventually but the probability that it could happen at 40 – 41 is higher to me. Which means I either step aside and sell and wait for 41 to pass or tighten my stops just under 40. This site is very good at identifying when the trend has turned and underway so a trader/investor can move in the right direction but is only able to identify the turn after the fact. It is not a criticism just a realistic fact and presents a very good trading/investing style.

have you ever thought of making an iphone app? with just an updated gmi/gmir/t2108 and may be a list of stocks at an all time high/52 week high ?

Haha, the iphone app is a cool idea. Is there any way to make the email updates go out faster? I get them sometimes a day or more after the post is online.

I love the IPhone app idea! I will ask my son and webmaster to look into it. I have been updating the blog mainly over the weekend for Monday. When my class starts next spring I will likely go back to daily. Better to just check it regularly to see if I have posted.