“Last week, a person who knows nothing about the market asked me how to short stocks. This is reminiscent of the stories of the shoeshine boys providing stock tips, near the roaring 20’s market’s top. The sentiment is just too negative right now. Does this mean the market has to turn up? Not necessarily, but the market is always an assessment of competing probabilities. “ (Post on 3/8/2009, GMI: 0, T2108: 7%)

I wrote the above words last March, which turned out to be just as the market successfully tested its bear market lows and began the current rise. The Worden T2108 indicator was in single digits, a rare screaming oversold buy signal. When people around me who never traded asked me how to short stocks it turned out to be a key contrary signal that the market decline was near an end. Similarly, I remember when a friend who knows little about the market asked me if he should refinance his house to invest in the market–back in 2000 near that market’s top………

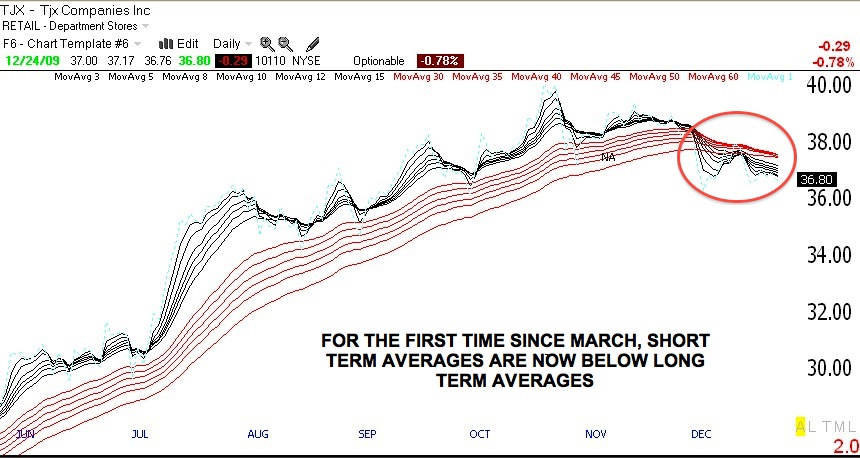

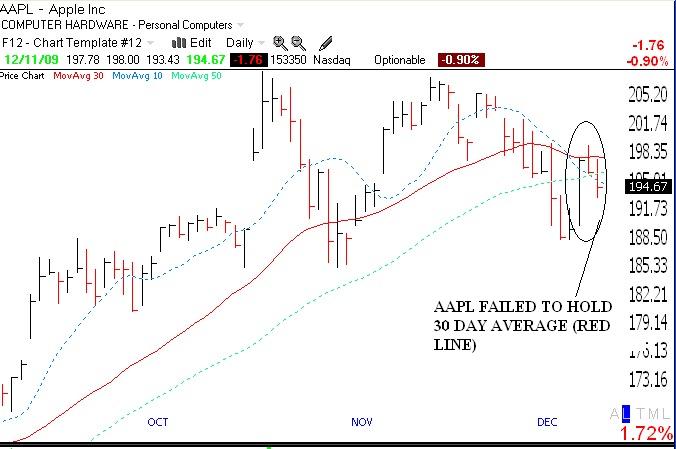

I have noticed that the pundits have been saying that TJX , the discount retailer chain, is a good buy. I therefore was struck by the GMMA daily chart below, which is flashing warning signals. With the short term averages (black lines) now below the longer term averages (red), this is not a stock I would want to own. It may even be a good short play. You do know that analysts sometimes tout a stock so that their big clients can unload their long positions to the unsuspecting public. (The “NA” on the chart shows when IBD wrote about TJX in its New America column.) Another stock with similarly weak technicals is PWRD.

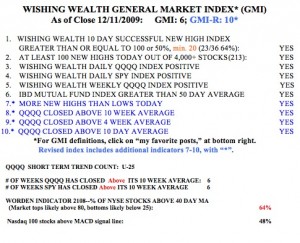

Meanwhile, the GMI and GMI-R