Watching AAPL as it approaches top 15.2 daily Bollinger Band, currently at 97.73:

42nd day of $QQQ short term up-trend; DC AAII work-shop July 19

Next Saturday, Dr. Alan Ellman and I will be doing an AAII work-shop in Virginia. I hope to see you there.

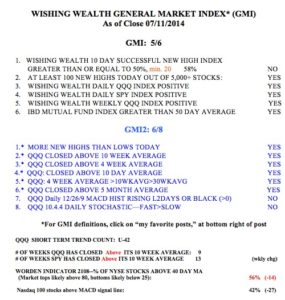

Meanwhile, GMI is at 5 (of 6) and still on a Buy signal.