I had been moving up my stops to protect my profits and have been stopped out of all positions in my trading accounts. Break-outs have been failing and growth stocks are faltering. T2108 is way down to a level not seen since last April.

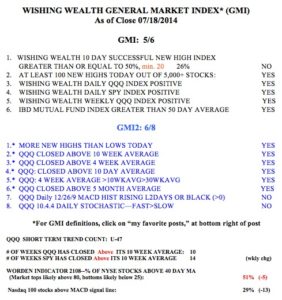

I am very cautious. The world news may be a distraction from the real underlying technical weakness in this market. At 46 days, the current QQQ short term up-trend is getting old. Since 2006, 79% of short term QQQ up-trends have ended in fewer than 50 days. Another weak day could easily send the GMI below the critical 3 level.