Screenshot

Stock Market Technical Indicators & Analysis

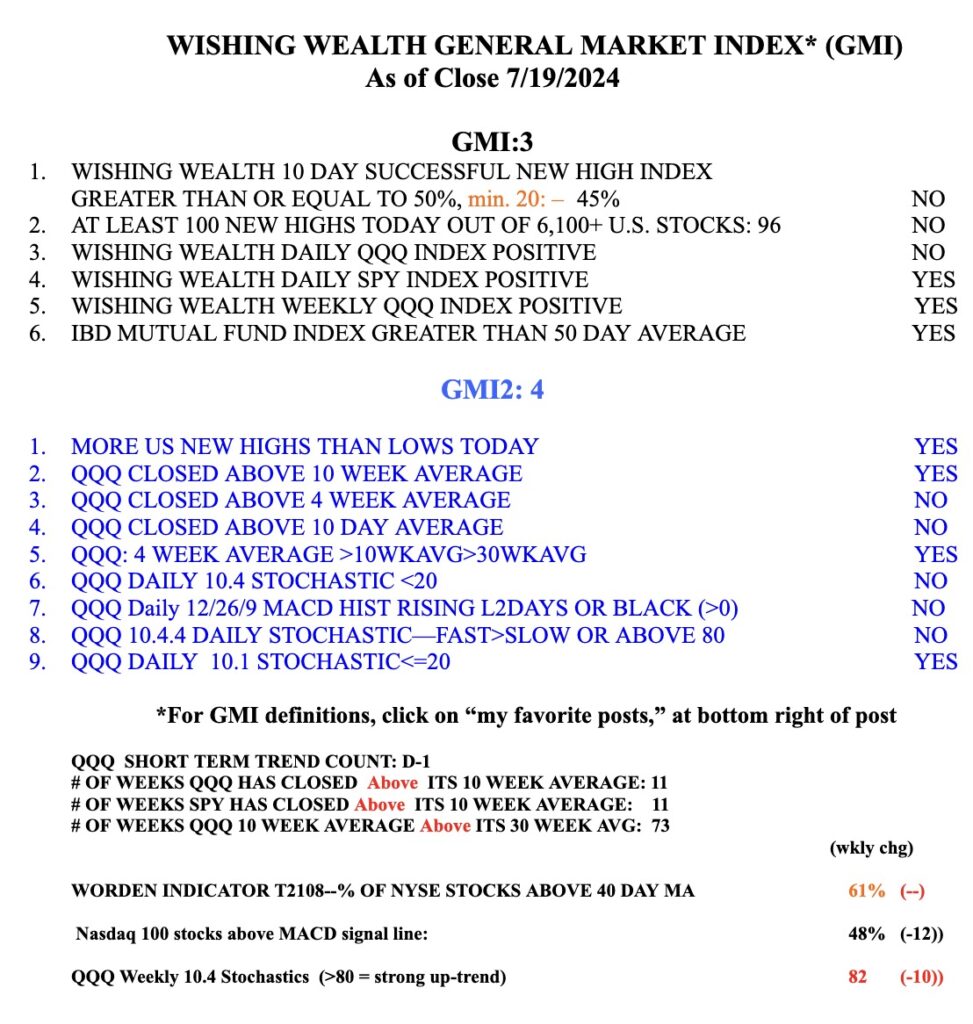

Roughly 40% of new short term down-trends end in 5 days or less. Once it passes 5 days I become more confident of the change in trend. Note the higher volume recently on the down days. My GMI is still on a Green signal. So I wait on the sidelines in my trading accounts and invested in mutual funds in my longer term retirement accounts.